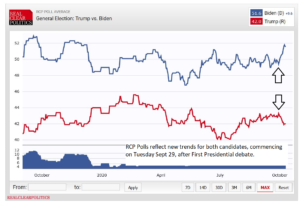

Good Morning folks, I hope this update finds everyone well. Now that we have the Presidential election behind us, let’s take a look at the markets and surrounding events. Bottom Line Up Front: The S&P 500 has risen 9.64% since November 2 (the day before the election), and small cap stocks appear to be the best performing category for the time being.

As many know, a few major events have occurred since the election, which is important because elections are major catalysts which influence the markets (see FAQ# 6): The US Supreme Court recently denied a Texas lawsuit seeking to overturn the vote in Pennsylvania, Michigan, Georgia and Wisconsin. Additionally, President Trump signed a stopgap funding bill keeping the federal government open until December 18, and the FDA approved Pfizer’s COVID vaccine.

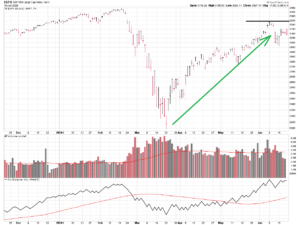

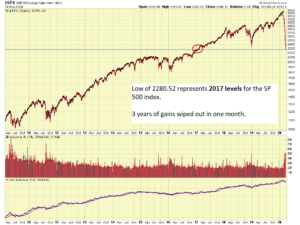

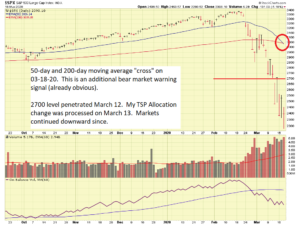

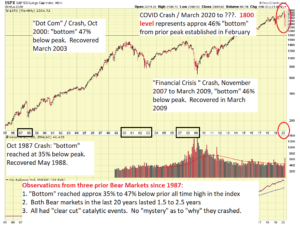

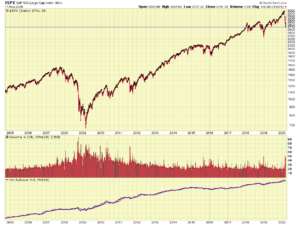

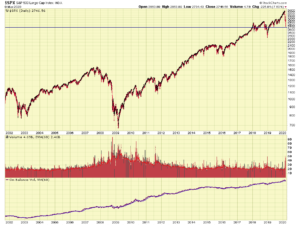

As stated above, the markets have rallied since the election. “Why” is a complicated question, however in a very general sense, the markets do not like uncertainty or unknowns. Let’s take a look at the S&P 500 chart:

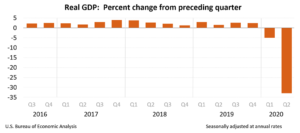

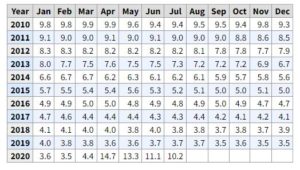

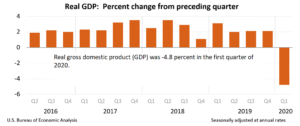

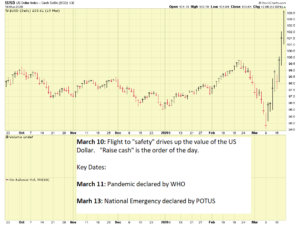

On November 2 (the day before the election) the index closed at 3310.24. Since then, it has risen 9.64%, a respectable number given the fact that it represents approximately one month of days that the markets were open. The energy and oil sector, an important jobs creator in Texas (and other areas), has witnessed oil prices subsequently rise, as demonstrated by the below Crude Oil and Energy Exchange Traded Fund (ETF) charts below:

I have posted previously on this site that a desirable price per barrel for Crude Oil is $55. With the current price above $45, we are making some progress towards that desired level, which results in profits for our large oil companies (and jobs), and still keeps the price at the retail gas pump at a level affordable to the consumer.

The energy sector ETF, ticker symbol “XLE”, has risen also, propelled by oil prices and optimism in the energy sector. Note that oil prices tend to rise in good economic conditions, and tend to fall when the economy is faltering. Rising prices arguably may be a harbinger of things ahead.

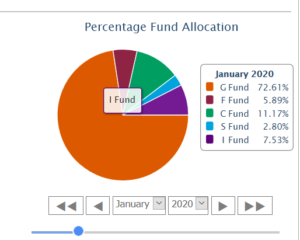

Since the election, small cap stocks have outperformed all others. Investment in small cap stocks is done via the S-Fund in the Thrift Savings Plan. The TSP investor may desire to research this further and use that information as he makes his own investment decisions. On a 30-day thru 90-day basis, the small caps are strongly outperforming the large cap (C-Fund) and international stocks (I-Fund), some weighting in the C-Fund might be a consideration for further research.

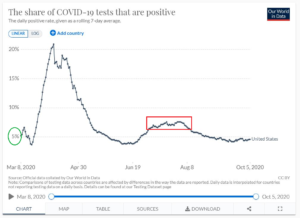

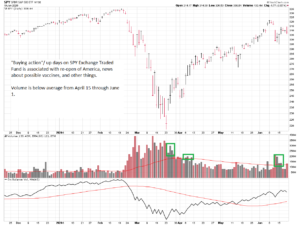

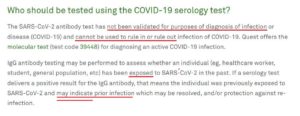

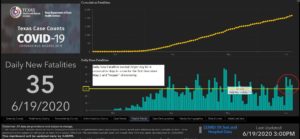

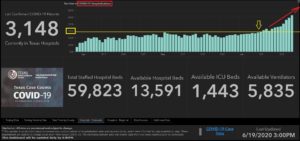

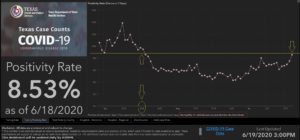

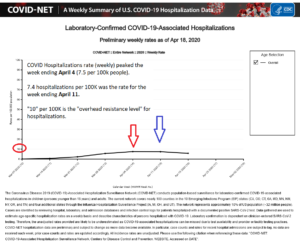

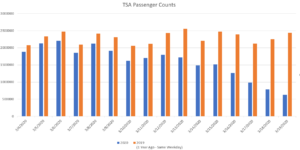

With the FDA vaccine authorization (and other countries also authorizing vaccines), this should further help the economy. Current death rates from COVID, using CDC data, are approaching April 2020 rates:

Airlines, restaurants, in-person retail, hopefully will see a rebound once vaccines are widely available. Not suffering is E-Commerce, as consumers order online and have everything shipped to their house. E-Commerce was booming before COVID, now it is on fire; as it solves a problem and makes life easier for millions of people. In summary, if you have a smartphone, you have a shopping mall, a grocery store, and a movie theater, all in your hand. Pretty powerful stuff, the future of which is basically unlimited, in my opinion.

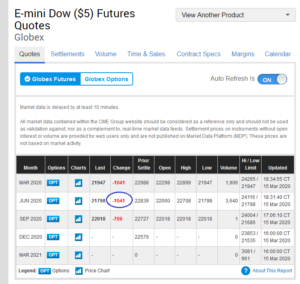

Regarding the federal budget, this is a huge unknown, however my opinion is the stopgap funding until December 18 will then expire and the government may see a shutdown after that. Hopefully Congress can agree on the COVID stimulus package prior to that. Again, my opinion, but the way I see this, the one week stopgap funding gets the federal workforce a full pay period “worked”, which will get the workforce paid for Christmas (EFT on/about Dec 24). However after December 18, we have Congress who may wish to go home for Christmas break, and the fact that the “new” Congress takes effect on January 3, 2021 may also complicate things. The January 20, 2021 inauguration is fast approaching also. I guess my point/opinion is we have a lot of stuff going on ahead, and I am not sure if a shutdown can be averted. My prediction (hope I am wrong): We shut down on Dec 19 thru ??? possibly January 3, 2021.

This concludes my current assessment of the markets. I hope everybody has a great weekend and is healthy and strong, as we wrap up a challenging year.

Please continue to share this website and email updates with friends and colleagues. They can subscribe via this link: http://www.thefedtrader.com/contact-us/

Thank you

-Bill Pritchard