Good Evening

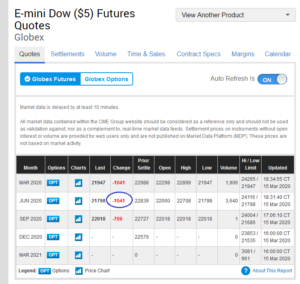

On Sunday March 15, Federal Reserve Chairman Powell announced an “emergency” rate cut, resulting in Federal Reserve rates of zero (0) percent. Most believe the “Fed” is now out of ammunition to further help the economy, and the markets. Note that while the Fed’s job is not to prop up the stock markets, the do markets pay close attention to monetary policy. Sadly, the Dow Jones futures traded 1,000 points down after the rate cut was announced:

Indeed the COVID-19 / Corona Virus situation is a catalytic event, discussed in Question #6 my FAQ. Such an event can clearly send the market down, (and up), and arguably this is the worst global economic event since Sept-11, and since the Financial Crisis 2007-2009.

On Sept 11, 2001, terrorist enemies attacked the United States, killing thousands of people. Americans were quick to rally and unite, and efforts to defeat the terrorists began. During the financial crisis of 2007-2009, banks, lenders, and other institutions began to weaken and display structural problems. These problems subsequently triggered a financial collapse, and a stock market crash. Indeed a big deal.

The COVID-19 situation is one that requires humans to remain away from each other. Reduce/eliminate social interaction. Change our behavior. Telework is being advocated, as such, side by side collaboration will be reduced. Workplace productivity, success, and project completion rates will be impacted. Try designing a rocketship over email and phone conferences. Selling cars, real estate, medical care, teaching class, sporting events, high school graduations, are traditionally “in person” activities. For those employees who enjoy working on a team and accomplishing things together, your team is now a bunch of folks on your email TO line. Some industries are better suited than others for this type of arrangement.

The International Monetary Fund (IMF) has already come out and stated that global economic growth will be severely impacted. The Organization for Economic Co-operation and Development (OECD) has stated that global growth may be cut in half.

With that, let me share my opinions about COVID-19. Included below is a chart of “Open Table” online restaurant bookings:

Apparent above is the the fact that despite COVID-19 being talked about since January, nobody (myself included) took it very seriously until recently. If eating in restaurants (which is associated to social activity and being near other people…) is any indicator, the world was eating in restaurants basically until March 1. Now, the world did not all get sick that day and decide to stop going to restaurants, but I believe a behavior change began on that date. If you look at March 8 (one week later), restaurant traffic continued to dry up. Note that the World Health Organization declared COVID-19 a Pandemic on March 11, and on March 13, President Trump declared a National Emergency. Hopefully “the word got out” by March 14 that this is a serious problem. Indeed restaurant reservations reflect that. Which is great, however COVID-19 has an approximate 14 day time lapse to display symptoms. As of today, real-time reporting from people I personally know in the health field tell me that many testing sites will not test you unless you display multiple CDC promulgated symptoms, said symptoms which do not all appear simultaneously. In summary, people are likely carrying the virus and do not know it. Further more, the 14-day time lapse, coupled with the only-recent realization that this is a serious matter, reflects a potential onslaught of positive tests in April. Date check: Today is March 15. I may be rambling incoherently (sometimes this happens…) but my point is the world was out in the public until basically today. Only now are folks begrudgingly changing their behaviors.

This will further feed the existing fear and paranoia factor (something we don’t need), as “more and more people are getting infected.” We now know, using my example above, that many indeed are probably infected now, but known infections still not well known or well documented. This lack of reporting has arguably encouraged a Laissez-faire attitude in the US, since “nobody has it.” In mid-April, I (sadly) feel things will be more grim.

As many know, I made some adjustments to my TSP Allocation on Thursday March 12. The “Bear Market” point was attained on the same day, when the S&P 500 traded below 2715. It is my opinion that the market will continue much lower. This concludes my opinion based analysis of the markets for now.

If you have not already done so, please participate in my POLL: https://www.poll-maker.com/poll2788829xc18a487c-82

Also, I have received some emails and messages to “please sign me up, here is my email address.” I simply cannot manually enter new 125 email addresses into my free site every night. I request folks take a look at the following link, and share it with anyone who may enjoy reading my opinion based analysis of the stock markets and impact on the TSP. Subscribe Link: http://www.thefedtrader.com/contact-us/

Thank you for reading…

-Bill Pritchard