Good Evening

As many know, President Trump spoke during Wednesday evening to the nation. Apparently his speech did nothing to pacify markets, with Dow Jones futures trading down over 1,000 points. Common sense has left the room, and pure panic and fear have hit the markets. As stated previously, (until mere weeks ago), our economy was on solid, strong footing, with full employment, strong housing numbers, and strong GDP. The economy is now under threat, as various travel bans take effect, tourism ceases, and business travel (the primary source of major airline revenue) slows, instead opting for video conferencing. As more and more people “self quarantine” (in accordance with government recommendations), retail spending will be impacted, and other areas will be impacted. Corporate earnings in coming months will indeed be poor. Which will likely fuel more selling and downward action, resulting in a self-fulfilling bear market crash.

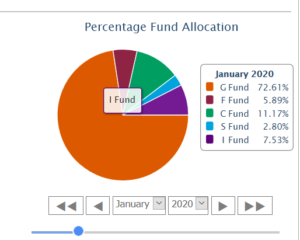

With that I will be changing my Asset Allocation in my TSP to reflect 75% G-Fund, 25% C-Fund. Why not 100% G ? Because I still believe: “nothing is (was) wrong” with the underlying economy; I hope (hope is not a strategy, but…) some common sense returns to the markets; and I believe in our country and its entrepreneurial spirit. We have overcome many things, and we will overcome this. However simple math also tells me I cannot watch my TSP vaporize. The above is basically the same thing as the L-Fund, the only difference is my all my non-G fund weighting is in large cap (C-Fund) stocks:

Some will be quick on the trigger that I am “locking in losses” with an asset allocation change.. Fact of the matter is the losses have occurred, and if the particular fund or asset class is not providing the risk/reward balance you desire, you may think about your need to change your asset allocation or an asset rebalance. Please read my March 8, 2020 post regarding Asset Allocation. This is not “my” idea, it indeed is “my” action though. I get some negative fan mail claiming my allocation changes are something I invented, but they are all within the four corners of the TSP handbook, SEC investor education guidance, and trusted financial company publications.

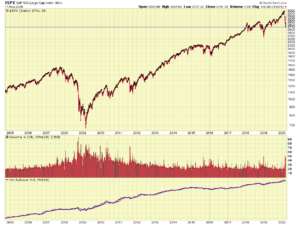

Note that recent action on the S&P 500 has brought it back to 2019 levels:

Also note that the markets are still very elevated and a market crash has still not fully developed.

In the event the markets find some common sense, and the downtrend reverses, my aforementioned allocation of 75% G-Fund and 25% C-Fund (again, very similar to L-Income fund) will see some partial gains. Observe that Fridays tend to be “sell-off” days…my allocation change should take effect before the market closes on Friday.

I strongly encourage the readership to learn more about asset allocation and making allocation changes. It is not all about return, investment choices are also about volatility, risk, and time horizon. A 25 year old employee who plans to retire at age 65 is in a different situation than a 63 year old who plans to retire at 65. There is not one magic solution for all.

Administrative Notice: I am posting this because we have a “new generation” of readers, recently coming into the workforce. Nice folks but the knowledge base and expectation level is different from seasoned long term TSP participants. This long existing (and free) website, in which I provide my opinion about the markets, and voluntarily disclose my TSP choices, has recently seen an uptick in communications to me with numerous “but why” questions, even some criticism that I “missed some gains” etc. I get numerous LinkedIn messages asking “Can you answer some questions” or “I know you are busy, but…” No sweat, thank you for reaching out, but if I spent only one hour a week developing website material, researching the markets, etc., at only one hour a week, that is four hours X $7.25 minimum wage, or $29 a month, in the event I were to put a price on my effort and time. As such, I plan to stop sharing my TSP allocation choices, and continuing this free site as an analysis-only site of the market’s action. Before I do this, I wish to poll the readership. Please take a moment and participate in this poll:

POLL: https://linkto.run/p/QV49C2P0

Thank you for reading. Let’s hope the Coronavirus market infection quickly resolves itself. Talk to you soon.

-Bill Pritchard