Good Evening

With the Dow Jones index losing 2,013 points today, March 9, 2020 was the worst trading day of the year. This was largely Coronavirus related, however a price war between Saudi Arabia and Russia did not help things. Since many energy companies occupy the Dow Jones Index, this already wounded index was hurt even more.

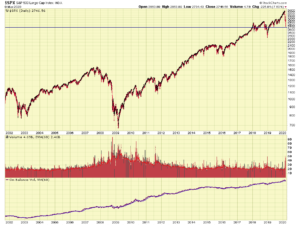

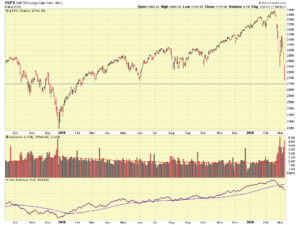

In my prior post I commented that I was watching the 2,700 level on the S&P 500, with 2715.20 as being “official” bear market territory. Let’s take a look at the 20-year chart, and an 18-month chart of the index, with the 2700 level noted:

Apparent in the above chart is the fact that we are basically approaching Year 2018 levels on the S&P 500. The pain previously inflicted has erased all of 2019’s gains. What took 12 months to build, took one month to crash. We have seen this in other bear markets, we saw this in 2007-2009, and in 2001-2003. This is because buying stock, and making investment choices, whether by the private investor or by a major institution, usually is a result of careful decision making and information gathering. Selling, on the other hand, typically is not done that way, and is usually a mad rush to “get out.”

This evening, President Trump announced a variety of measures, to include:

1. Payroll Tax relief

2. Financial help for hourly wage earners

3. Small Business Administration (SBA) actions to help small business

4. Hotel, Airline, Cruise industry special measures

The Dow Jones evening futures rallied 500 points on this news, however it is yet to be seen how Tuesday’s stock market will behave. Let’s keep our fingers crossed.

With a close price of 2715.20 or lower, the S&P 500 will be in a Bear Market. A few other technical things still need to line up, but cracking 2715 will trigger additional selling and rebalancing of assets in the world, which means things will get much worse, before they get better, once the textbook definition of a Bear Market is attained.

Lets see if it can keep its head above the water.

– Bill Pritchard