Good Evening

“Quick publish with minimal proof reading” – Just an FYI that tonight’s Dow Jones futures are trading lower by about 1,200 points. This clearly is undesirable, and while trading sentiment can change between now (11PM Central) and the morning, it is not likely. As such, Monday March 9 trading in the US stock markets is likely to be bloody, as investors continue to panic-sell out of response to the Coronavirus and its related economic impact.

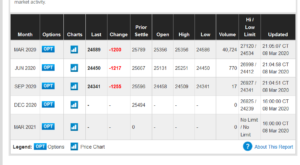

Gold, as expected, is at new highs, being a safe-haven investment:

“Great Bill, more charts, what are we supposed to do with this ?” you probably are asking. Great question, it is one I am asking myself. Note that retirees cannot contribute into the TSP, as such they are in the most vulnerable camp in regards to crashing markets. There is no “continue to make contributions” for a retiree, or “think of it like you are buying shares at a discount” [a belief I have never supported, but…]. A retiree is not contributing, he/she is not buying any more shares. If I was retired, I might be looking at the G-Fund as an Coronavirus investment option right now. As a matter of fact, disregard what I said (I will be blamed to inviting flee-to-G-Fund panic), and lets look at what the TSP says for the retirees. TSP Command Central says:

So there, don’t send me hate mail when I say “consider shifting to the G-Fund”. Send it to the TSP….

Back to my commentary.

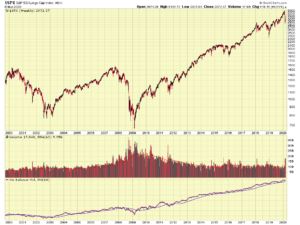

Note that the markets still have a way to go, this correction has not developed into a full blown bear market yet, commonly identified as a 20% decline from the prior high. On the SP-500, this would be the 2715.20 level, which is 20% from its high of 3394.

Lets take a look at the weekly (versus daily prices) chart of the SP-500:

Lets take a look now at the daily chart, with various support levels noted since May 2019 (approximately 12 months into the past). You will observe that the 2700 to 2800 zone is where support is found. My opinion is a CLOSE PRICE (end of day, the market closes) of 2700 or below is cause for alarm. It also represents an area where an exit to the G-Fund (possibly a partial exit) would still protect earnings accumulated right up to approximately mid-2018.

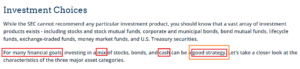

This is a great time for further discussion on “Asset Allocation.” For the moment, consider Large Cap stocks (C-Fund), Small Cap stocks (S-Fund), etc. to be “asset classes” or “categories” (terms often used interchangeably). Do not listen to me, lets look at what our friends at the SEC say about Asset Allocation:

As you can see, asset allocation is indeed a tool in the toolbox for reducing risk and exposure to the markets. Be cautious when you get advice (especially the retirees) to “buy more, it is on sale.” 1) Retirees are UNABLE to buy more 2) The “sale price” may go even lower, RE: Enron, 3) Once losses exceed 10%, it becomes harder and harder to regain them. A $100,000 balance that is down 30% is now worth $70,000. To recover that loss (which was $30,000), a gain of 42% is needed. Only one time in history (at the beginning of the 2003 bull market) has the TSP ever approached that level. Remember, that is to break even. If you get this in your inbox, you might get a second opinion:

I am not going to beat up the “buy and hold forever” crowd, if it works for you, then use it. I have my opinions though. There are 9,599 different mutual funds in America, and 6,900 Exchange Traded Funds globally. So, apparently there are 16,499 various opinions and investment strategies out there….

Summary: I am watching the 2700-2800 level on the SP 500, which may be a trigger for me to move some, or all, of my TSP, to the G-Fund.

Lets see what happens this week. Monday March 9 is not looking good…

-Bill Pritchard