Howdy folks

Opinion based commentary….

As we all know, the Coronavirus has infected the markets, resulting in severe down days, losses, and extreme levels of volatility. Call me crazy but I am maintaining my TSP Allocation of 50% C-Fund and 50% S-Fund, as I consider the Coronavirus to be a “Black Swan Event” (discussed previously on my website in 2013 and 2014) and without prediction. Furthermore, there is no “lead up” to this type of event: it is panic in nature, akin to somebody saying “fire” in a movie theater and everybody dies because they got trampled to death at the exits. I ask that the Wall Street folks breathe for a minute. There is some argument that mainstream media is over-blowing this topic, which, while important, is possibly being used to steer voter opinion in this current election year.

Note that China is indeed the world’s factory. If the factory closes, the world economy hurts. No doubt. I get it, everybody gets that. If Apple’s Ipad manufacturing is stopped, and they cannot fulfill orders, Apple does not sell as many this quarter, and quarterly earnings are impacted, and the stock goes down. Look, I get it. If Japan Air Lines cannot sell tickets to Japan, they loose money. I get it. However that data has not come in yet, we do not know exactly the impact that this virus will have on corporate earnings.

On March 2, 2020, the Dow Jones index rallied 1,293 points, the most it has ever gained percentage wise since 2009. This was fueled by hope that a global response will occur, via fiscal measures, from the FOMC, IMF, and ECB, to help mitigate downside from the Coronavirus. Let’s hope this stimulus comes through.

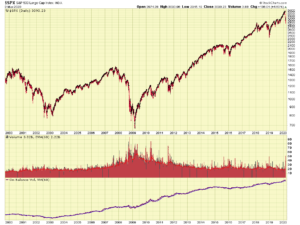

Let’s take a look at the 6 month chart of the S&P 500 Index, then a 20 year chart. The 6 month chart is painful. The “big picture” / “long term” chart not so much:

Important ! Does this mean I am going to ride my personal TSP account to zero ? Watch it vaporize away ? As most know, I am not a “invest in stocks and leave it forever” guy. I am also not a TSP day trader. My strategy calls for an analysis of the fundamental and the technical picture, when that is done, I make allocation adjustments based on my risk tolerance. When the investor adjusts his allocation, this is called an “allocation strategy.” Admittedly, going 100% G-Fund may be too risk averse, however for me, myself, and I, this is what helps me sleep at night when it gets stormy outside.

Side note: Over the years, a few TSP information sites have come and gone, one fairly popular one stopped publishing all together, leaving a bunch of subscribers wondering what happened. That site, like many others, was run by somebody using a pseudonym name. Other sites have no identifiable human owner, just some PO Box addresses. Mine (this one) has existed in various forms since 2001, or almost 20 years. I believe I am accurate to state that this site has expanded and enhanced a lot of people’s understanding of the TSP and the markets. I would ask that people stick to who they trust, our (my) opinions may not triple your accounts by next year, and you may disagree with those opinions, but at least you know what you are getting from the start. I would recommend folks continue to pay attention to Dan Jamison, CPA of the FERS Guide, and Chris Barfield, CPA of Barfield Financial (check LinkedIn or google search). Both Dan and Chris provide outstanding benefits and TSP related information. I highly recommend listening to what they say. They are real humans, and you can trust them. Kind of a big deal in today’s world of internet, overnight popup websites, and the impersonal advice industry. Just my opinion…

With that said, my TSP Allocation is unchanged (for now).

Thank you for reading….

-Bill Pritchard