Good Evening

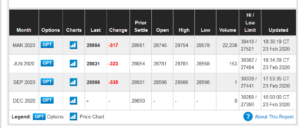

FYI that Dow Jones futures are reflecting a 300 point drop down, attributed to continued coronavirus fears. If this continues into the morning stock session, the markets will have a painful Monday. See current futures values:

Gold futures are also trading up, classic “safe haven” behavior when stocks are down:

Note that the “Coronavirus” has many similarities to the common flu, per John Hopkins University: https://www.hopkinsmedicine.org/health/conditions-and-diseases/coronavirus/coronavirus-disease-2019-vs-the-flu

Harvard University Medical School states that preventative measures against the flu will likely also work for coronavirus: https://www.health.harvard.edu/blog/be-careful-where-you-get-your-news-about-coronavirus-2020020118801

With the hypothesis that the flu and the coronavirus are similar, it is important to note that investment decisions should come with the awareness that flu cases subside in April:

Being that we are soon entering March, I see no reason to panic-bail out of stocks and into safer investments such as the G-Fund, as I see the coronavirus situation as short lived. Longer lasting economic impact may indeed occur, however it is not known what, if any, effect, this will have (long term) on the stock markets.

For now, my TSP allocation remains unchanged.

Lets hope that April gets here soon, and that the coronavirus cases start to subside.

Thanks for reading….

-Bill Pritchard