Good Afternoon Folks

My apologies for a delayed update- the summer has been very busy for me, it seems that I no longer get “me time” anymore- I know many are in the same situation. Add the “lock down effect” into the mix, once the local parks and recreation areas opened up (with appropriate safety measures in place) for use, my family was out of the house. I even almost near-drowned being towed behind a ski boat (my skills are market analysis, not water sports behind a ski boat) as I enjoyed my freedom. COVID has reminded me to appreciate the outdoors…just simple walks outside have become very enjoyable. Before COVID, if my neighbor asked me to “go for a walk” I would look at him like he had five eyes.

Back to the markets and the TSP. Note that I have included a Poll link at the end of this update. Please complete this poll, as it helps me stay in tune with my audience. I had a reader email me regarding “other TSP sites”, as one site (or discussion forum?) he mentioned has demonized being conservative and having the majority of your TSP in the G-Fund.

I do not subscribe to negative energy, so I told the person above who emailed me (he was close to retirement) that he needs to talk to a professional advisor for an official opinion, with that said, he needs to do what he is comfortable doing. This reader correctly identified the fact that we are in a “pandemic” and in a global recession. Remember, the TSP site itself identifies the G-Fund as being useful for preservation and stability of your money. I did not invent or patent the non-cosmic idea of being conservative. With that said, please complete the Poll at the end.

Let’s continue on to my opinion based analysis of the markets….

Allow me to start with the chart of the “Spider” “SPY” Exchange Traded Fund (ETF) with tracks the behavior of the S&P 500 Index, my default barometer for the markets. Volume analysis of the SPY is a little easier for me, hence my use of it:

As can be seen, the markets rallied in late March, triggering an uptrend which still exists. The top performing TSP funds are S-Fund as top performer, and C-Fund as next best performer. It is important to note that summer volume has been rather light in the markets, adding credence to the theory that retail investors, versus institutional investors, are the active participants in recent months. This means “smart money” is staying away. To dispel/prove this, lets take a look at the price of the de-factor safe haven currency, Gold, something most retail investors do not dabble with:

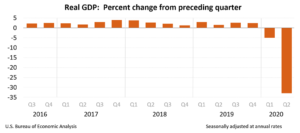

Based on the gold chart, it appears Gold has rallied since March (interestingly, so has the stock market…hence my “retail investor” theory). Gold rallies when economic conditions are poor or worrisome, which indeed they are. Allow me to use this as an opportunity to state that the stock market and the economy, are two different things. Yes, they often behave in unison (RE: 2007-2009 Financial Crisis) but at times they do not. This is known as “decoupling” and that is in effect now. To begin my economic discussion, lets take a look at the GDP chart:

Recent economic reports and indicators paint a bleak picture of the economy. The most recent GDP report reflects a -32.9% contraction in economic activity during the second quarter. This follows -5% GDP for the prior quarter. Two consecutive negative GDP reports fulfill the textbook definition of a recession. As such, the United States is currently in a recession. Important to note is that this is almost entirely the result of the COVID situation, and not anyone’s “fault” or from any mismanagement. The CEO of American Airlines cannot be blamed because nobody is flying right now. When a local bakery closes its doors, and goes out of business, because the town is “locked down” and nobody is buying custom birthday cakes for now-cancelled birthday parties, it is not the bakery owner’s “fault” the business closed. That is why this COVID situation is so delicate, it threatens our health, our economy, and more importantly, our futures. With that said, the cold hard truth is that the U.S. is in a recession. Furthermore, the International Monetary Fund (IMF) has stated a recession exists globally. Since 1900, no sitting US President has won re-election to a second term during a recession. None. This is important as we make investment decisions in October and face a possible change in administration. Whether the current President gets penalized for this recession, it still yet to be determined.

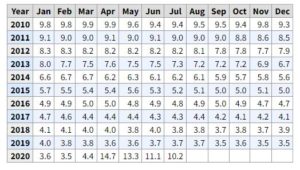

Unemployment data (again, not anyone’s “fault”) is at all time highs, however has started to recover since March:

Currently, 10.2% of the labor force is capable of being employed, but is jobless and unemployed. This is down from 14.7% back in April. Irrespective of cause or “fault”, 16.3M people in our country are unemployed, which impacts discretionary spending and other things, which have impact to the economy.

Currently, 10.2% of the labor force is capable of being employed, but is jobless and unemployed. This is down from 14.7% back in April. Irrespective of cause or “fault”, 16.3M people in our country are unemployed, which impacts discretionary spending and other things, which have impact to the economy.

With that said, school is opening soon and soon we will know if, and to what extent, COVID impacts our youth, as schools have been out of session since March. This may play into further “shut down” decisions. Thankfully, kids seem to have a resilience to COVID, typically not getting sick at all. Some theorize this is associated to numerous vaccines obtained at a young age, for whatever reason, these vaccines may be help keep COVID away. In any event, we will know soon enough.

For the reasons above, my allocation of 75% G-Fund and 25% C-Fund, similar to an L-Fund, will continue. I am optimistic about our great country, and about our ability to overcome obstacles. I hope a vaccine is developed soon, and that we can resume life as we used to know it.

Thank you for reading, I hope everyone has a great rest of their summer. Please complete the poll below. Thank you

POLL: https://www.quiz-maker.com/poll3070068x478E43f6-95

– Bill Pritchard