Happy Columbus Day weekend everybody. More and more I am only finding time to update this free website on major holiday weekends or during a “lull” in numerous family events that are going on right now. Sports, music, Scouts, etc. No excuse, so here we go with today’s update, where I share my opinion on what the market has done, and why.

This recent week (10-05 to 10-09) witnessed the market’s best week in 3 (three) months. This is really great news. Hence a good time for this update. My overly conservative (I get beat up over being conservative on this free no-cost site, and about my “over use” of the G-Fund, oh well…) opinion that 75% G-Fund and 25% C-Fund is the ideal allocation is likely being met with frowns from the audience. As such, the standard disclaimer remains: Manage your own TSP as you see fit. If you are a 22 year old Border Patrol Agent, with 35 years ahead of you, most of it at the GS-13 level and higher, maybe 100% G-Fund is not the place to be right now. If you are 56.998 years old, retiring in a few months, maybe 100% I-Fund is not the best idea either. Talk to you financial advisor, planner, etc. With that said, a more aggressive approach, presently, will likely result in more gains, due to the market’s recent strong performance. On a long term view, the C-Fund has been outperforming the other funds, however more shorter term, the S-Fund has been the top performer. Sure, you can “invest all of it in the C-Fund and never look back” because “the C-Fund always goes up.” News flash to thousands of mutual fund managers, CFP’s, retirement counselors, university MBA and finance programs, and Jim Cramer: you can all quit now, your services are not needed….we have found the magic recipe for investment success. I digress…

Important: Historically speaking, when small cap stocks suddenly display a fresh energy, and outperform large caps, this is one indication of a new market uptrend underway. Let’s take a look at a chart of the S&P 500:

As you can see, the market crashed somewhat, most of September. Most believe this is associated to political fighting over the COVID stimulus package. While opinions abound from both sides (and I have my own also…) regarding socialism and “bailing out” businesses, versus letting free market forces take effect, at the end of the day this is America and we have a duty to protect the weak and defenseless. What does this mean? It means that we have thousands of unemployed folks, with no medical care, no paychecks, and an uncertain future, because of the COVID situation. Small, entrepreneurial businesses are especially hit hard. The bakery that closed because no more birthday parties, and no more cake orders. The local restaurant that just couldn’t make it thru the shutdown. Etc. As such, some positive energy exists that the stimulus package will be signed and put into effect, helping trigger the market’s rebound.

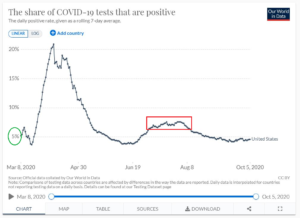

COVID itself appears to be under control, at least overall, across America. Some states (South and North Dakota) have seen a spike, but if we can keep the COVID cases under control, ideally below 5% positivity rates, more calm will return to the markets. We only recently went below 5% (overall for the country) in August. See chart:

So two elements to the market’s continued health include the control of COVID, and the stimulus bill itself. Which brings us to the next element, the election. I will attempt to be bipartisan and agnostic as I discuss this market driver, and keep the elements of my discussion to be economic/market focused. Observe in my FAQ #6, political change indeed is a huge catalyst for the market.

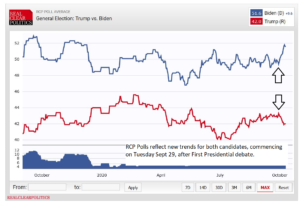

Historically, the markets do better under a Democrat President, versus a Republican. Lets return to our discussion of the recent uptrend. It began on September 24, a Thursday, then we had the weekend, then on September 29, a Tuesday, we had the first Presidential debate. I am not going to comment on who won or who did not win, but the pollsters at Real Clear Politics aggregate all the polls around the country and develop their own score regarding which candidate is seen more favorably by the voters. Since the debate, Biden has been outperforming Trump in the polls. Simultaneously, the stock market uptrend which got started a few days prior to the debate, has grown stronger. See chart:

Is there any linkage between the market uptrend and the recent polls (assuming the polls are accurate) ? Maybe yes, maybe not. The polls have not negatively impacted the market uptrend. So while you and I may have our own personal preference at the voting booth, the stock market may be deciding its own preference right before our eyes.

With that said, the election is 23 days away. Basically two pay periods and the next Commander in Chief is elected. In my opinion, the election will rest on the states of Florida, Ohio, and Iowa. All are “toss up” states and contain a large number of Electoral Votes within. Most political analysts consider Florida a “must win” for any candidate; one cannot be President without winning Florida. So once that is done, Ohio and Iowa will be important. Pennsylvania is important also, with 20 Electoral Votes. Hence the state’s name was mentioned three times at the first VP debate. However, sometimes politicians have a detachment from reality- fracking jobs are a direct result of the price of natural gas, a Pennsylvania leading industry. Natural gas prices have been in a decline since the year 2008, simply a matter of supply, demand, and pipeline infrastructure. See chart:

Not sure any politician, from any party, can wave a magic wand and bring the natural gas and fracking industry back.

There you go folks….two pay periods of time and we have a new President. The markets have been doing very well in recent weeks, hopefully this continues.

I wish everyone a great weekend. If not already done so, please complete my poll regarding your sources of TSP information. Link: https://www.quiz-maker.com/poll3070068x478E43f6-95

Thank you for reading ! Talk to you soon…

-Bill Pritchard