Hello folks

Bottom Line Up Front: I remain 50% S-Fund, and 50% C-Fund, a position I have held since June 2023. This is my personal TSP allocation- let’s talk about my view of the markets and my thought process behind my own personal TSP decisions.

Note: If the graphics/images in this post to do make it past your email spam filters, please proceed directly to the website itself to view this update. Link: https://www.thefedtrader.com/

Also, to help reduce the chances of these updates being sent to you spam folder, please adjust your email settings (Outlook: Rules Wizard, Yahoo/others: “create a filter”) to send all email from The Fed Trader to your inbox. If you need help, some articles exist via google search that explain how to do this.

Ok, moving forward…as stated in the title of this post, the markets are doing outstanding as we close out the first quarter of the year. Some may recall my prior January post, in which I discussed above average volume. This continues, carrying the trend of the market upward. (We will get into “why” shortly)

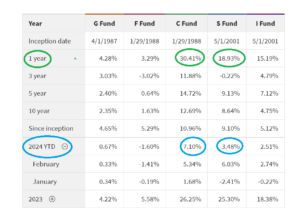

Since June, I have been 50% S-Fund and 50% C-Fund, and most followers of this free site are in a similar allocation. Which is great, as (drum roll…) out of the “core” TSP stock funds, the C and S funds happen to be the top two performers:

I performed an analysis of the multiple funds, and my conclusion is that for the next three to six months, the S-Fund and C-Fund will be the best choice. The I-Fund has shown some positive signs also, however I think domestically (at least for now) is where the action is at. Hence, I continue to be in the S-Fund and C-Fund.

Driving all of this are the same, familiar themes: The economy, inflation, and interest rates. Any political instability we may see towards the end of the year indeed may impact the markets, but until my technical and chart analysis tells me otherwise, I am remaining fully invested.

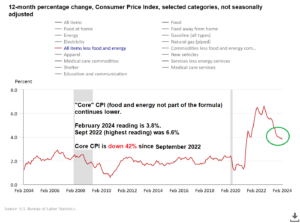

Inflation data, Core CPI notably, is down 42% from its 2022 highs. “Wait, what?” Yes, that is correct. Core CPI is down 42%. See chart:

The Federal Reserve’s goal is to see inflation fall to 2%, at which point, interest rate hikes will be halted completely, even lowered. A review of data from the March 20, 2024 FOMC meeting (link: https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20240320.htm) it appears they feel Core PCE (another inflation measure) will be achieved in 2026. Not an entirely bad thing, as “mid-2024” is rapidly approaching. However if this is like any other federal agency I am familiar with, public statements are usually very conservative and aligned with the concept of under-promise/over-deliver. By my estimates, using Core CPI as the benchmark, at its current rate of improvement, using Sept 2022 as the starting point, I estimate 2.0% Core CPI to be achieved by early 2025.

In summary, so far this year, we have seen positive economic progress, with the markets resoundingly voting its satisfaction via the strong uptrend see in large cap and small cap stocks.

With that, I will conclude this update. Again, I am 50% S-Fund and 50% C-fund.

If you know someone who may benefit from being subscriber to my updates, please share my website with them.

Thank you….

-Bill Pritchard