A somewhat overdue update…

Good Evening to everybody and Hello from “retirement-land,” an odd and chaos-free world, where you no longer carry a work cell phone, you don’t have to put in a leave slip anymore, and you are not constantly deleting emails because somebody sent a global world-wide distribution (with a red exclamation mark) that some office has a FAX-line out of service.

I highly recommend entering this world, as soon as you can.

With that said, it is time for an update from your favorite opinion based TSP and stock market analysis site, aka The Fed Trader. The last few months (sans AL-slip, and free of mandatory HQ travel notifications), have been spent white-water rafting and hiking in Colorado, then at a beach in Mexico, somewhere else watching a professional soccer game, and other fun stuff. Updates have been sporadic I know but please don’t beat me up too badly. However, some things indeed are brewing on the horizon so it is time for an update. In the last few months, honestly, no earth shattering single-issue news has hit, and I have thus not reported on much, however a combination of things is brewing right now which may, or may not (“opinion based”), impact the markets and subsequently your TSP performance. Pleasant cheerful reminder that I do not give investment advice and how you manage your TSP is up to you. Also, this is not a political site and I try to post factual information and data, in almost all cases developed via my own analysis. At times the data and information may have an [INSERT PARTY]-lean to it, trust me, it is not designed that way. Moving forward…

My opinion right now is we have two threats ahead, notably Inflation and the COVID Resurge, or potential panic-attacks because of a perceived resurge.

Lets first, before we start, look at the stock market itself. Why? Because at the end of the day, it does not matter what a bunch of market analysts, economists, me, or investment advisors think, it just matters what the market does. So what is it doing?

If we look back 30 to 90 days, my typical investing horizon (apparently my typical website-update horizon too), we will see that the C-Fund is performing best, or “least worst” of all the funds. We will also see that the S-Fund is getting clobbered recently, as various NASDAQ stocks and small company stocks start to feel what many believe to be pains associated to inflation, supply chain (planes, trains, automobiles), and supply shortages themselves (lumber, computer chips, etc.). Large super sized companies, the Microsofts and General Electrics of the world, can tolerate some of those things a little better than the smaller companies.

Lets look at a chart of the SPY exchange-traded-fund, a proxy for the S&P 500:

As can be seen, the SPY ETF remains in an uptrend, however it saw some selling/distribution back in March, then in May, then in June. It remains above its 50 day Moving Average, and technically is still in an uptrend. However I would have preferred to not see the selling/distribution in recent months.

Lets talk about the “threats” as I see them. First, inflation. Two different price indexes are popular for measuring inflation: the consumer price index (CPI) from the Bureau of Labor Statistics and the personal consumption expenditures price index (PCE) from the Bureau of Economic Analysis. Each of these is constructed for different groups of goods and services, most notably a headline (or overall) measure and a core (which excludes food and energy prices) measure. It should be noted that the Federal Reserve uses the PCE index as a tool when making monetary policy decisions.

The Consumer Price Index (CPI), which is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The CPI reflects the largest increase in consumer inflation since 2008 (we all know what happened that year…the housing crash….).

PCE Inflation shows a similar trend, well, inflation is indeed here, again, at all time highs in over ten years.

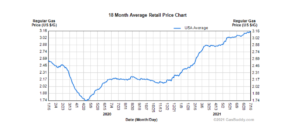

At some point, all this self-corrects. Consumers decide that their incomes did not go up 25% this year, so they cannot afford the gas that has doubled, or the steak dinner that tripled, and stop spending. Note: Gas prices are up 45% since summer 2020:

Did you get a 45% raise? Probably not, and this is a simplified demonstration of inflation. Goods start to cost more than people can afford. Like I said, at some point it self-corrects.

The final threat, in my eyes, is the perceived (but sure looks real-to-me), COVID resurge, notably the Delta variant. My uneducated research reveals that the majority of the newly infected are either not-vaccinated people, or unfortunate others in 3rd world countries who received various Russian and Chinese vaccines with reduced efficacies. They are “vaccinated”, masks come off, and back to regular business. However infections start soon thereafter.

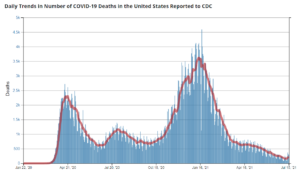

Looking at “body counts” and “deaths”, the following charts appear to reflect a reversal of the COVID death trend:

The good news, is INSIDE America, COVID seems to be “under control”, the economy is coming back, and summer travel is booming. But this can be subject to change with the Delta variant, reportedly more contagious than other strains, and also the now dominant strain in the US.

So there you have it folks, “things as I see them.” Note, due to my retired status, I am very risk-averse with my TSP and as such, have changed things to 75% G-Fund, 25% C-Fund. Before all the Kevins and Karens cry or post on LinkedIn that I am too conservative and use the G-Fund too much, the above allocation is basically the same as the L-Fund. Yes, Wall Street fund managers want you to NOT SELL your investments when times get rough, those managers get paid for assets under management (AUM). “Hang in there Mr Investor” / “Think about the long haul” / etc. Furthermore, yes, the G-Fund can be part of your road to wealth, albeit slower, per this June 15, 2021 article in Federal News Network:

Quote: “……Many years ago, I spent lunches with co-workers, and we would discuss the TSP and where everyone planned to invest their accounts. Back in those days, our only options were just the G, C, F, and I Funds, a small fraction of current TSP funds. Many believed the economy looked promising and spoke about investing aggressively in the C fund. Others chose a more cautious path by not taking any chances and investing 100% of their account in the G fund. In my opinion, both paths of investing — whether aggressive or cautious — can lead to success; you just need to make the choice that will let you sleep at night……”

Wow, powerful. “Let you sleep at night.” I have only said that a zillion times on this site. Glad to see this concept supported over at Federal News Network. Remember, the TSP official website itself, states that investors should consider investing in the G Fund if you would like to have all or a portion of your TSP account completely protected from loss. That is not from me, that is from the TSP. I didn’t “invent” the concept of moving to G-Fund to be protected from loss.

Summary:

1. Some threats exist, Inflation and COVID, on the path ahead.

2. For my personal risk tolerance and ability to sleep at night, I will be changing to 75% G-Fund, 25% C-Fund.

Hope you enjoyed this update, if you feel it is useful please share it with friends and coworkers. A few TSP analysis sites have come and gone over the years (all claiming to be a “different approach”) but this one remains strong, with continued subscriber growth each month and multi-thousands of subscribers from every federal agency under the moon. Thank you !

Talk to you soon….

-Bill Pritchard