Good Evening everyone

The first trading week of March is now behind us, and it has been quite a week. Please bear with me as I share my opinions and my assessment of recent market activity. My personal TSP Allocation of 100% S-Fund has not changed. Why not? I am not a TSP day trader, and instead prefer a long term view of the funds. A variety of theories, strategies, beliefs, etc. exist out there (just Google search “TSP”) regarding the best way to manage your TSP- just do what works for you. “Works for you” may mean absolute total returns, it can also mean “be able to sleep at night”, or a combination of the two. 8,000 mutual funds exist in the USA, how many ways exist to invest in stocks? 8,000? Not sure, but apparently it is a big business if 8,000 funds exist. Ok, enough soap-boxing, lets move on to what I think is happening in the markets.

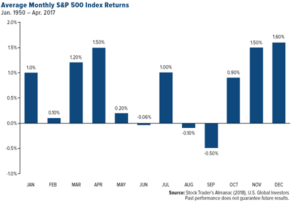

Interestingly, the first day of March 2021 was the best S&P 500 day since June 2020. This was a great way to kick the month off, a month that historically has given us good performance as shown by the below graphic:

Less than desirable however, was the subsequent “mini crash” the various indexes had after March 1, arguably fueled by the rise in 10-year Treasury Yields which many believe is associated to risk of rising inflation. (Note: the Dow Jones finished Friday 572 points up for that day…..)

This subsequently causes a fear that the Federal Reserve may change monetary policy and thus some nervousness enters the markets. However, I am not personally getting too wrapped around the axle about Treasury Yields, not yet, because my other “indicators” (that is checkpoint-speak) show (relatively) smooth roads ahead. What are these? They are gold, crude oil, and the overall trend of the indexes. Lets look at gold, the default safe-haven investment.

As can be seen in the chart, investors are not suddenly flocking to Gold, because “the markets are tanking.” Gold is down hard, reflecting outpouring of investment.

Lets take a look at Crude Oil, which has seen a spectacular rise in recent months, great news for the oil industry. I have spoken about this before; many believe rising Crude Oil prices reflect a strengthening economy, and Crude Oil is increasing rapidly:

The price climb is obvious on the above charts, a climb which began in November 2020. I recently spoke with a friend from West Texas, an owner of an oil service company, he reports that the industry expects a very positive 2021. This is further supported by this article: https://oilprice.com/Energy/Energy-General/Why-Big-Oil-Expects-Record-Cash-Flow-In-2021.html

So we have two fairly reliable (in my opinion) indicators which seem to paint a positive picture. That leaves us with the S&P 500 index itself:

While this week has been volatile, the overall uptrend is still intact. The index has only closed below its 50-day moving average once, and that was on March 4. Indeed volume has increased on the “down” days, but we have seen some positive volume on the “up” days also.

With that, I conclude this update. Again, my TSP Allocation has not changed.

I hope everyone is doing well and for those traveling or vacationing on Spring Break in the coming weeks, have a safe vacation. Also, please continue to share this site with your friends and colleagues. For those who need benefits and retirement program information, beyond market/TSP analysis, always keep in mind Dan Jamison, who authors the FERS Guide book.

Thank you and talk to you soon….

-Bill Pritchard