Howdy Folks (that is Texas A&M-speak for Hello…)

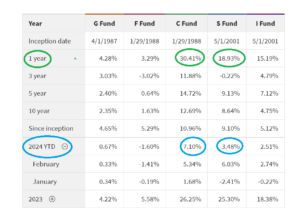

No, not many posts from me over the summer, my “second job” / retirement job had me busier than I anticipated, and just could not devote the required time for quality posts here. I did indeed watch the markets daily, and have made no changes to my current TSP Allocation of 50% C-Fund and 50% S-Fund.

“Bill, the world is ending, and things are spiraling out of control. Are you sure about this investment allocation?”

Good (and frequent) question, one I get posed to me in person, email, or via social media. I too am guilty of worrying, to a degree, about world, and domestic, events. However, Black Swan events are something I do not respond to, discussed in these prior posts, dating back to 2013 (gee, feeling old, ten years ago…): https://www.thefedtrader.com/?s=%22black+swan%22

For quick reference, a Black Swan event, is defined by the CFI Institute as being is an extremely negative event or occurrence that is impossibly difficult to predict. In other words, black swan events are events that are unexpected and unknowable. The term was popularized by former Wall Street trader Nassim Nicholas Taleb, who wrote about the concept in his 2001 book Fooled by Randomness.

I do not change investment allocations in a reactionary move to these events. Post-event, economic and financial market deterioration- sure, I might. Event-itself ? No changes. This is a great time to remind the readership that contrary to (some) popular belief, no, I do not “day trade” my TSP. General reminder that I simply seek the best performance at all times. Sometimes “zero return” is indeed a better performance than -10% (negative ten percent).

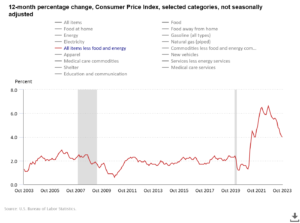

With that said, this year (2023) has been the longest not-happened-yet recession that has ever been predicted. I too, am guilty of quasi-predicting the “looming recession.” I spoke of recession-like environment in prior posts. Yes, gas is high. Yes, true, inflation is upon us. But– COVID is in the past (shocker, contrary to the doomsayers on some media outlets), in many industries, people are back at work, if not 5 days a week, at least via hybrid schedules, Zoom stock is at all time lows, roads and highways are witnessing traffic like never before, airports and TSA lines are crowded, and any given weekend, you can drive past a soccer field and games and kids are out and active. So, me, myself ? I am not so sure “the world is ending” or that financial doom is lurking around the next corner, like an evil bogeyman. Lets back my opinion up with some data…

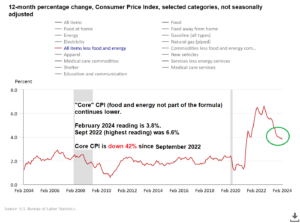

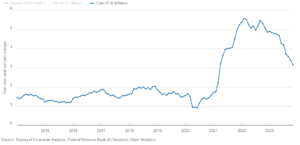

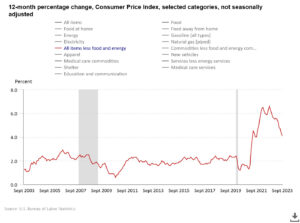

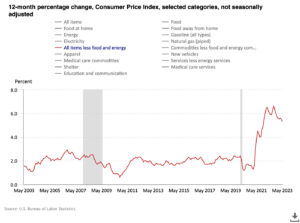

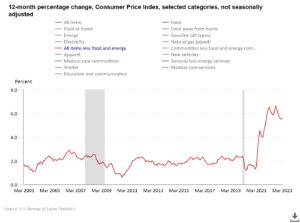

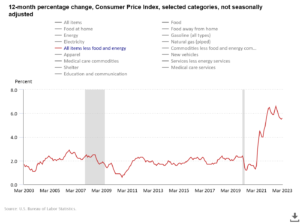

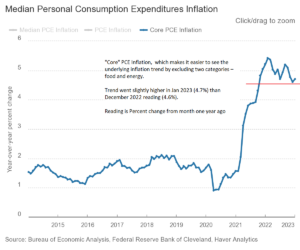

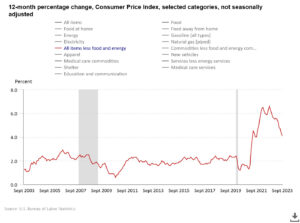

Inflation – Yes it is up, but…

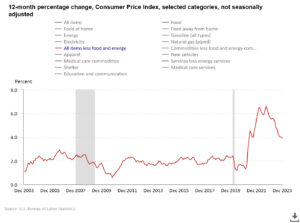

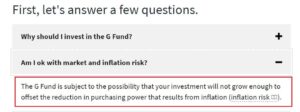

Inflation is indeed up, but it is coming down, however so slightly. If we look at recent “Core CPI” (food and energy prices removed from the data, due to its volatility), the Core CPI is coming down:

Most recent Core CPI reading comes in at 4.1%, much lower than peak readings in late 2022 above 6%. Indeed, some of these higher readings in 2021 and 2022 were likely downstream by products of COVID: closed factories, supply chain issues, resource scarcity (and higher prices). Flash forward to late 2023, and inflation is coming down, on a downward trend since Sept 2022 peak. So we are headed in the right direction, inflation-wise.

Most recent Core CPI reading comes in at 4.1%, much lower than peak readings in late 2022 above 6%. Indeed, some of these higher readings in 2021 and 2022 were likely downstream by products of COVID: closed factories, supply chain issues, resource scarcity (and higher prices). Flash forward to late 2023, and inflation is coming down, on a downward trend since Sept 2022 peak. So we are headed in the right direction, inflation-wise.

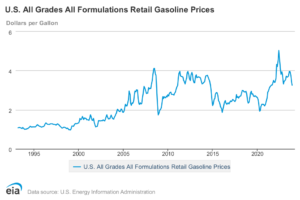

Oil Prices:

Related to inflation, but not counted in Core CPI, but yes still important, are oil prices. “Gas prices” impact just about every American who has to drive to school or to work or to the store to buy milk. Oil prices, too, are down. The sad and tragic recent terrorist attack on Israel by Hamas sent oil skyrocketing, but only briefly. Lets take a look at recent Crude Oil prices:

Crude hit $95 a barrel on Sept 28, 2023. Previously it traded in the $70-$80 range, fairly reliably. Yes, that is double the range it traded at in 2020, $30-$40. But apples to apples. In 2020, COVID hit- schools closed, office workers stayed home, airliners got parked, cruise ships went to Port. Did this result in a fuel shortage, or a fuel abundance? COVID, hitting us in the Spring of 2020, didn’t even make us Yes, gas got pretty cheap. Will gas ever go back to 2020 levels? What do you think? In sum, I am not losing sleep over gas prices. I, like everyone else, want it cheaper. But will that happen? Time will tell. A good article about this is here: https://read.oecd-ilibrary.org/view/?ref=136_136801-aw9nps8afk&title=The-impact-of-Coronavirus-COVID-19-and-the-global-oil-price-shock-on-the-fiscal-position-of-oil-exporting-developing-countries

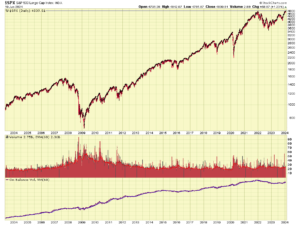

The Stock Market

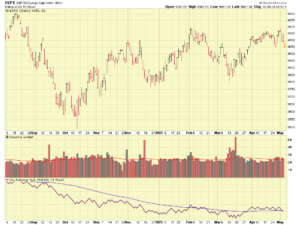

The ultimate barometer is the stock market. “Price tells all” is a common Wall Street mantra, and it means the price of the underlying index or stock is the value of that stock, and includes all the information economic and otherwise that should influence the stock’s value. Not future earnings, Forward P/E, forecasts, etc etc. Right now, the price is X. That is the value. The value of 4200 on the SP 500 was an important overhead resistance level, the upward penetration of that back in June 2023 is what triggered my return to the S-Fund and C-Fund. The markets then rallied, then dropped down some. Important to be aware of is that per the Stock Traders Almanac, September is the worst month every year for the markets. So September of 2023 was bad. Do I panic and jump to G-Fund? Or do I say, wait a minute, September is always bad, lets monitor things some more? For me, I remain in the stock funds. See chart:

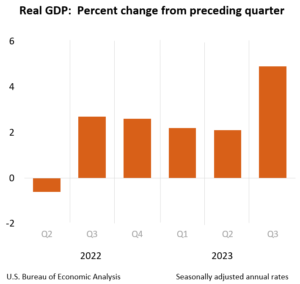

We have another cool tool in the toolbox regarding recessions, produced by the St Louis Federal Reserve, titled Smoothed US Recession Probabilities chart. Smoothed recession probabilities for the United States are obtained from a model applied to four monthly variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade. When the chart value exceeds 1.5, it signals that recessionary conditions exist and a recession may be probable. Going back 30 years, the following values existed prior to the subsequent recession a few months later:

November 2007: 1.78. “Global Financial crisis” soon afterward, related to housing and banking.

October 2000: 3.52. “NASDAQ crash” aka “Dot Com crash” soon after.

June 1990: 2.68 “Slow growth” recession after this- the country was still trying to regain footing after the 1987 stock market crash, Gulf War, Keating Five and Savings and Loan scandal

The current reading as of now? 0.20 (zero point two zero). See chart:

With that said, I remain 50% S-Fund and 50% C-Fund.

POLL:

Is a recession looming? I don’t know. What do you think? Please share your opinion in this Poll: https://poll-maker.com/poll4965833x9bF3452D-152

Thank you for reading and talk to you soon.

-Bill Pritchard