Good evening….I wanted to update everyone that tonight’s electronic trading of equity indexes (E-Mini SP 500 and E-Mini D0w) have shown significant gains over the prior session. These are traded worldwide, electronically, and are open for trading beginning Sunday evening, then 24 hours each day, until Friday evening, when they stop trading until Sunday evening. Sunday behavior is usually good “intel” on how Monday’s regular stock markets will behave. I have the sick habit of checking them every Sunday night, which determines if I lie awake all night in a cold sweat due to nervousness, or if I sleep soundly with a smile. Tonight I will have a smile.

E-Mini SP 500 Futures are trading up 17 Points

E-Mini Dow Futures are trading up 162 Points

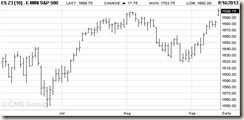

Lets look at the charts:

As can be seen, both indexes “gapped up” (a concept explained in my last post on this site), indicating strength and bullishness. Most successful traders believe a “Gap Up” requires the establishment of a long position/buying shares.

Tonight’s activity is likely associated to the news that Larry Summers has withdrawn his name for consideration to be Ben Bernanke’s replacement. As always, the market itself ultimately serves as the signal for our trading moves, not outside news or trying to crystal ball / predict the market.

Most of my subscribers should already be “in position” in the S-Fund and/or I-Fund due to my opinions regarding bullish/positive behavior in the indexes, discussed in depth on this website. If Monday 09-16-2013 stock market activity behaves like tonight’s futures, then those who are “in position” will benefit greatly.

Thank you for reading and let’s see how this week turns out. I am very optimistic. As always, if you find www.thefedtrader.com a useful and informative website, please share it with your colleagues and coworkers. Good Night.

– Bill Pritchard