NOTE: If the images in this post do not appear, your email or internet provider may be blocking HTML or blocking graphics due to spam and other concerns. In that case, please go directly to my website to view this content: http://www.thefedtrader.com/

Well, first things first. I wish all my loyal readers and followers a Merry Christmas and Happy New Year. I would wish “Happy New Year” to the markets if I could but I am not sure they would listen. So allow me to talk about what I see happening. Bottom Line Up Front: I am personally 100% G-Fund, which represents the best allocation for my personal risk tolerance and my personal economic situation. For official guidance and information on the use of the G-Fund (such as “How can I use the G-Fund in my TSP?”) , please consult the TSP website itself at: https://www.tsp.gov/funds-individual/g-fund/

Note that per official TSP website fund performance, the G-Fund is the only positive performer 2022 Year to Date. Indeed, the return is not +1000%, but it is positive versus negative.

And when is the evil and ineffective strategy called “market timing” not evil and ineffective? Well, when Wall Street hedge fund managers decide to re-label it as something else, maybe call it “rebalancing”, see below:

Words used include “trim holdings” / “move funds” / “unload” / “shift assets”

Now, when individual investors decide to be proactive with their own accounts and “shift assets” we become “market timers” and are reminded we are not smart enough to understand what we are doing. Soapbox rant off…

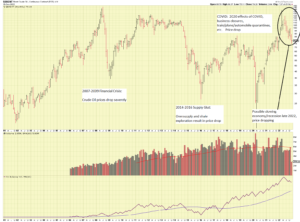

Lets take a look at the SPY Exchange Traded Fund, a great proxy for the S&P 500. Volume analysis on the SPY chart is a little easier for me, so lets take a look:

As can be seen on the chart, the market continues to trend downward. Above average volume action seems to be the constant theme. Indeed we had some “up days”, on Nov 30, and Dec 13, respectively, but (“experts” on cable business news channels aside…) the bearish downtrend has remained intact. Challenges remaining for the market, and the economy, include high interest rates, inverted yield curves, and inflation itself. Lets take a look at a chart of negative yields:

Apparent in this chart is when things go below “O” (zero), a recession occurs soon after. Our current negative reading of 10-year/3-Month yields reflect a reading of -0.83, a number greater than the previous worst reading of -0.77, which was in December 2000. So, basically, the yield curve is in the worst shape it has ever been in 20 years. Again, recessions typically begin after negative yield curves develop.

Apparently, large investors are buying gold, since November, the price has been in an uptrend since then:

Gold, historically, is a “safe haven” investment, and while this is not as a reliable indicator as it as decades ago, it is still good for general awareness. Gold typically rises when stocks go down.

Crude Oil, is another indicator of problems ahead. “Low priced” Crude Oil is not necessarily a good thing. Crude Oil is always “low” in a recession or even a depression. Crude oil was low during the financial crisis of 2007-2009, during COVID crisis of 2020, and is showing signs of going down again, per this chart:

So there you have it folks, my opinion-based analysis of the markets. I hope you find it useful. If you do, please share this free website with others, and encourage them to subscribe (request #1). Also, if you have not already done so, please complete this poll below (request #2) as it helps me stay abreast of current sentiment in the subscriber ranks…

As we finish 2022, a cursory review of “other” TSP analysis blogs and websites reveals preliminarily that back in late 2021, and in 2022, The Fed Trader website has been the ONLY site to discuss the potential bearish market conditions and deteriorating economy. FYI

POLL: https://take.quiz-maker.com/poll4595721xC9dD40b9-144

Thank you. Merry Christmas and Happy New Year.

– Bill Pritchard

Incoming search terms:

- https://www thefedtrader com/author/admin/