Hello Folks

This week has lots in store, many things are in the works which may impact your TSP balance. Whether it will be positive or negative is to be determined. Lets talk about a few of those things. Before we get far down the road, allow me to state that my personal TSP Allocation is 100% G-Fund. Have I missed some gains ? As I discussed in a prior post, I sure have, however I refuse to “chase gains” and abandon my own system based methodologies, using technical analysis and volume action as my primary tools. Some have said the “The Fed Trader just chases moves in the market” well I hope my length in the G-Fund helps dispel that belief. Keep in mind that I am not providing recommendations, advice, or financial consulting on this free site. Disclaimer is Here.

Indeed the market has gone up this year (so far), however I think if you re-wind the tape, the market gets a boost from something positive in the news, then it goes flat, then somebody juices things again with a news release, it goes up for awhile, then flat, then another news article comes out. Like invisible summer thermals, there is no true substance behind these moves. Volume is lackluster, and a closer look behind the scenes reflects some economic indicators displaying a cooling economy. Let’s get started with a look at the S&P 500:

Visible above is the lack of volume (with the exception of strong buying action on June 28) over the last few months. I have said on this site numerous times that volume is the foundation holding any price move up, without volume, prices can fall quickly. Of course, they have not, and those in the G-Fund have missed some gains. However my confidence would be boosted if volume came into the markets.

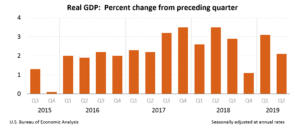

On July 26, 2019, the most recent GDP figures (2Q 2019) were released:

Consumer spending had its smallest gain in four months. Some believe “consumer spending” makes up 60-70% of the GDP. In this category are purchases of motor vehicles, clothing, food, housing, and recreational activity. Government spending accounts for 18-20% of the GDP, as does business investment. Some very stimulating GDP information can be found at this link: https://www.bea.gov/system/files/2019-05/Chapters-1-4.pdf

Another indicator often used to gage things is the Yield Curve. I have discussed it here numerous times, so I will not repeat myself, however note that it remains inverted:

This is evident in the above chart, with the spreads below zero. This is a fairly reliable indicator of a slowing economy.

Yet another indicator of things cooling off, we have the Chicago Business Barometer, which depicts business and manufacturing activity across the United States. If is often believed to be the best leading indicator of the economy. Leading, not lagging (historical), because factories and production of widgets slow down long before a full blown recession develops. See below graphic, courtesy of Trading Economics website.

The above indicator reflects a contracting manufacturing climate.

This week a few important events are underway:

July 31: FOMC meeting concludes, likely with an announced 25 basic point interest rate cut. Note to self: You don’t cut rates in a booming economy. Look past the public news statements and look at action, not words. The FOMC is cutting rates. Why ? Volume action behind any up-moves in the markets will be important. Does “big money'” jump in ? Or does the market go up on lackluster volume yet again ?

August 2: Jobs Report/Employment Situation is released.

All week: Team from US is in China attempting to restart tariff and trade talks, with the hopes of reaching an agreement. China, a communist country, with a long history of espionage, running intercepts on US military aircraft, and computer hacking, has been asked to agree to concessions on intellectual property theft and the increase of US goods purchased by China. Opinion: I don’t see any agreement ever happening. We need to install a drop-dead date and hold them accountable, or not, and move forward from there. Period, the end. This wishy-washy, numerous visits with no deal, tariffs-are-postponed-yet-again, etc. stuff is becoming very frustrating.

Summary: Based on volume action and market response to the rate cut, and Chinese tariff negotiations, I am open minded to returning to stock funds, but will wait until I see clear and convincing evidence to justify my return to the stock funds. I remain 100% G-Fund until then.

Thank you for reading, talk to you soon…

-Bill Pritchard