Good Evening

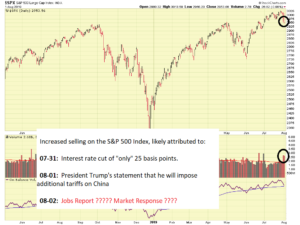

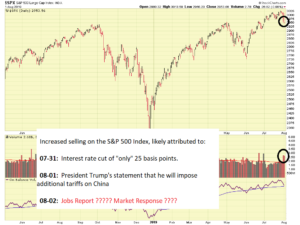

Likely attributed to the July 31 “small” interest rate cut of 25 basis points by the FOMC, and the August 1 announcement by President Trump regarding placing additional tariffs on China (effective September 1), the markets plummeted on both days, on very high volume. US Soybean prices, our top agricultural import into China, and grown by US farmers, also plummeted. As discussed previously, China is seeking alternative sources of soybeans besides the USA- as a result, the soybean farmer’s railcars of soybeans may soon have no buyer, resulting in lots of inventory laying around and thus prices going lower. Lets look at some charts:

Evident above is the recent action in the S&P 500. Above average volume selling can be seen which occurred over the last two days. This is known as “distribution”

Not directly related to our TSP, however it is important to show the damage the “trade wars” can have on our US farmers. If China elects to buy from another Source of Supply, that will have a negative impact to our US economy. Additional info regarding agricultural products sold to China is here: https://www.mda.state.mn.us/sites/default/files/inline-files/profilechina.pdf

Friday August 2 is the Department of Labor “Jobs Report” (for July) release. Economists seem to be looking for 150,000 to 165,000 jobs created, and an unemployment rate of 3.6 to 3.7%. These numbers are “expected.” Anything grossly dissimilar (EX: 125,000 jobs created, unemployment at 3.9%) may cause a negative market reaction, as this ostensibly may be an indicator that the economy is slowing. Note that “bad news is good news” sometimes: bad news may send the message the interest rates will go even lower (to accommodate the bad news), resulting in the market rallying. It is very hard to out-think the market. Thus the importance of discipline and sticking to (whatever) system works for your comfort level and risk tolerance. The US/China trade situation has concerned me all year, unfortunately an agreement does not appear in the near future.

I remain 100% G-Fund and will be monitoring things on Friday August-2.

Thank you for reading….

-Bill Pritchard