Good Evening

As discussed in prior posts, the 2725 level / trendline in the SP 500 index was important- unfortunately it was breached today October 23. I have no compelling information or reasons to keep me in stock funds in this time of increased volatility and turbulence, as such, I will be moving to G-Fund, 100% Contribution Allocations and 100% Interfund Transfer over to G-Fund. Lets talk a little bit about things as I see them:

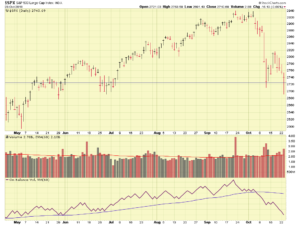

Apparent in the chart above is the 2725 level break, this occurred on high volume, a negative sign. Note that recent “sell off days” were also on high volume, all red flags. Gold Prices, typically a “safe haven” currency are on the rise:

Numerous things are challenging the markets, I will not regurgitate what I have already said, however the below are the challenges ahead:

- Global trade and tariff concerns

- Rising interest rates

- Poor corporate earnings by Caterpillar and 3M, both large US corporations with global business portfolio. These companies are among a group of companies believed to act as a barometer for the economy.

- Concerns over Saudi Arabia and death of journalist Khashoggi. President Trump has threatened economic sanctions and accused Saudi Arabia as participating in a “cover up.”

- 2018 Mid-Term elections: Any sway of power from one party to another could jeopardize pro-Economy regulation and policy being implemented today.

As reported on this site previously, the housing sector is already cooling off, this has trickle-down impact on the retail sector, construction, commodities, and other areas. Expect to see “the housing story” to pick up steam in the mainstream financial media in three to six months. Only a few folks have spoken about this: much distaste is left over from the 2007-2009 housing-induced, easy mortgage, financial crisis. As such, this story is not a popular one to talk about. But all indications are that housing is cooling off.

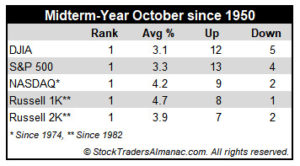

Also troublesome, is the fact that October is typically one of the best performing months of the year, with a 3+% return for the month:

As we arrive to the last full week of October, the month is negative for the entire month– it will be almost impossible to obtain a 3% gain between today and Oct-31. This “behavior” is not reflective of a healthy market. When a star quarterback suddenly can’t make passes, something is wrong.

In my opinion, things may rally back up in the coming weeks, but the “smart money” will sell into this rally (if it occurs…), capturing some last-minute gains, but then, soon after, the bottom may fall out of the markets. A technical indicator, the 50-Day and 200-Day moving average, indeed reflects a possible downturn ahead.

In sum, I am changing my personal TSP to 100% G-Fund, both the Contribution Allocation and Interfund Transfer. If the skies clear up in a month or two, I will re-enter stock funds. The G-Fund, of many funds, are “shelves” inside a safe, the safe being your TSP Account. Moving from one fund to another is not “cashing out”. Until you open the door to the safe, and remove dump the contents on the floor, you are still “investing” albeit in a reduced risk fund. Do not listen to the “experts” on the internet (more TSP advisory sites and chat groups exist than I can count with both hands…) that claim the G-Fund is not investing or that you should always be in stocks, etc. I can assure you I have never had trouble sleeping when the markets were shaky and my TSP was G-Fund. I occasionally get asked about such advice and those sites and quite frankly, most of them are garbage. Stick to trusted and known information sources, such as Dan Jamison’s FERS Guide or similar reputable sites. The TSP site itself endorses the use of the G-Fund for account protection: https://www.tsp.gov/InvestmentFunds/FundOptions/fundPerformance_G.html

With that said, I am enroute to G-Fund. Will the markets suddenly rally and prove me wrong ? I hope so. Until then, I need a little shelter from the storm clouds I think are forming.

Thank you for reading…

-Bill Pritchard