Good Morning

Indeed this month has been a roller-coaster. October, historically a top performer, will likely under-perform this year; that fact alone is a red-flag itself regarding what lies ahead (if you believe that kind of stuff- I do…).

Lets talk about some of my opinions regarding what is challenging the markets. Back in July 15, I said this about inflation:

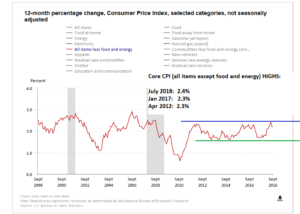

“…However some economic data has started to trickle in which may negatively impact the bull market. Inflation data, as measured by the Consumer Price Index (CPI), minus Food and Energy, reflects that inflation has risen to all time highs, at a 2.3% 12-month change rate….”

Fast forward to today, and the mainstream financial media is talking about “the inflation story” (reported by me in July). Inflation is on the rise, but if you look at the below charts, inflation’s rise is much subdued, while interest rates have risen rapidly since December 2015. Both PCE Inflation (the Federal Reserve’s preferred benchmark) and Core CPI (more widely followed in financial press circles) inflation is shown. This prompts me to ask “Are rate hikes the proper thing to do ?”

Apparent is that inflation has ticked up, however also observe that shortly after it goes up, the data reflects that it goes back down. Since 2012, it has been contained in a relatively narrow trading range. However, in December 2015, the interest rate hikes began, reportedly “in response to rising inflation”.

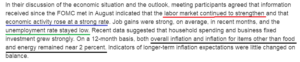

If we take a look at the most recent Federal Open Market Committee (FOMC) Minutes (LINK: https://www.federalreserve.gov/monetarypolicy/fomcminutes20180926.htm ) we will see this comment:

Allow me to make the observation that per the Federal government’s own Department of Labor data, unemployment is at the lowest it has been in history. I did not invent this or otherwise make it up. It is what it is. So I must ask: Why is the FOMC insistent on continued rate hikes ? I do not have the answer. My opinion is they should throttle back on rate hikes and put the rate-hike pistol back into the holster for now.

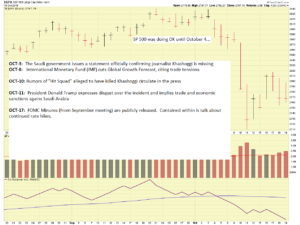

Lets talk about the SP 500 Index, my benchmark barometer for the health of the markets. The index was doing “fine” until October 4, when all heck broke loose. In recent weeks, the International Monetary Fund (IMF) cut global growth forecasts (citing trade tensions), a Saudi journalist was reportedly hacked to death in the confines of a diplomatic consulate building (prompting threats of economic sanctions on Saudi Arabia) and the minutes from the September FOMC meeting were released. See graphic:

One reason I did not pull the ejection handles over to G-Fund (panic response) was I wanted to assess the scene first. In aviation, the first thing a Pilot is trained to do when an emergency arises is “wind your watch” – in other words, breathe, assess, then act. The action in October resembles a panic response (by others) to numerous news events, but as I have said before, the “economic foundation” is very strong. Jobs, innovation, productivity, etc is still very strong in our country. The markets will indeed be impacted by continued interest rate hikes. I feel this is the #1 threat against the market, with the #2 threat being inflation. Tariffs also have the potential to hurt the markets, even though “I get it” as to why President Trump wants them. However my personal opinion is the stock markets are not going to like tariffs. The housing/real estate sector is already cooling off, as reported by Bloomberg on October 15: https://www.bloomberg.com/view/articles/2018-10-15/housing-prices-may-have-entered-a-cyclical-downturn

Housing impacts other industries, banks, retail (Home Depot, Lowes), manufacturing, textiles (roofing products, lumber), and other industries. When housing slows down, it contaminates other areas and is not something the already weakened stock market needs.

The 2725 level in the SP 500 what I am watching next:

A downward penetration of this level reflects a high probability the market will go lower. This will trigger the oft-asked question: “Why get out now? We are already down, it is too late.” Allow me to remind the audience that the G-Fund is considered an investment vehicle, albeit a reduced rate of return. The TSP website itself says this: Consider investing in the G Fund if you would like to have all or a portion of your TSP account completely protected from loss.

Note that it takes months for large institutions to “unwind” positions, so any additional problems we see this month or next will likely result in much more severe downward action three to six months ahead, something I don’t want my TSP exposed to.

In sum: My TSP allocation has not changed, but a downward break below 2725 on the SP 500 will likely trigger a change to the G-Fund in my personal TSP, unless clear and convincing evidence exists against it.

Again: I have made no changes to my TSP, however a move to G-Fund may be in my near future.

Thanks for reading…

-Bill Pritchard