Good Evening

Entering the “final stretch” of September, historically a poor performing month for the markets, we are faced with some storm clouds ahead. I have discussed these clouds in prior posts and unfortunately all remain in our path. I will discuss this shortly, however first lets take a look at August TSP Fund performance:

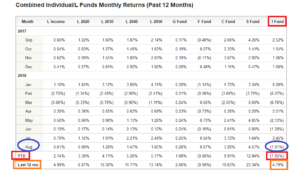

As can be seen, the I-Fund was again the worst performer for the recent reporting period (August), and remains the worst Year to Date (YTD) performer of all the funds. The “It is not a real investment” G-Fund outperformed the I-Fund in both instances above. To be clear: you could be 100% G-Fund and you would have outperformed 100% I-Fund. The top performing funds of all ten choices remain the S-Fund and C-Fund: I have been investing in both (and posting my TSP Allocation on this site) since December 2017.

Moving forward, this post is being written on September 25, 2018. By the time you read it, the FOMC may have concluded its September 25/26 meeting and elected to raise interest rates, expected to be increased by a quarter point. The markets have likely “priced this into things”- as such they may not sell off, but my crystal ball is sometimes broken. More importantly, in my opinion, is the language used by FOMC Chairman Powell at the post-meeting press conference, if the economy is growing and strong, this may cause the markets to respond positively in coming days. Some head winds exist, all my opinion…discussed below…

Tariffs: I am personally concerned that implementation of tariffs can indeed impact the economy. My views on this have become more polarized in recent months. I recognize the “good intent” and the “well-meaning idea” behind it, however my amateur opinion is the price has to be absorbed, or passed onto, somebody, most likely the customer. Tariffs, and retaliatory tariffs by the “opposing side” may be negative for the economy. Most MBA programs teach that big corporation’s #1 goal is retain, or improve, shareholder value, this is done via “making money” – profit and earnings (not sales). As such, if you absorb the costs, this impacts your bottom line. If you pass the cost to the customer, he may balk and decide he is going to scale back consumption of the product or terminate the consumption of the product entirely. This, too, impacts the bottom line. Remove the tariffs from the equation and things work in a free market environment, the highest quality product typically outsells the competitor, and there is minimal governmental involvement. My very simple view of things causes me to conclude that costs passed onto the consumer will result in an inflationary effect.

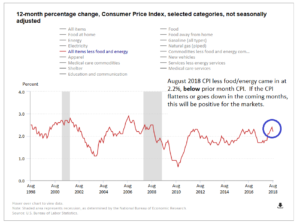

Inflation: Discussed in prior posts, inflation has picked up somewhat in recent months, approaching ten-year high levels (Sept 2008 Core CPI was 2.5%). On a brighter note, August 2018 Core CPI data has come in at 2.2%, below its 2.4% level in July. A flattening or decrease in inflation will be positive, however as discussed above, using tariffs (and their inflationary effect) to “help” the economy may be akin to believing that fat-free sugar cookies and sour cream on a wheat bagel are healthy food choices. Well intended, but probably not the best idea. My opinion. Core CPI Inflation chart below:

Interest Rates: The hot ticket items the market is concerned with are inflation, and interest rates. The FOMC is raising rates to “contain” inflation, the theory being that if it becomes expensive to borrow money, spending will slow down, and the reduced demand for goods will cause prices (the inflation side of the equation) to come down. As stated in numerous posts over the years on this site, if you consider the economy to be a sick patient in the hospital, the FOMC is the medical team. Once the patient heals up and gets better, medical intervention (low-interest rates, Quantitative Easing, etc) ceases. Our economy indeed is doing very well (important to note is almost all data is historical in nature, not predictive), the downside to this is interest rate hikes. I do wonder if tariffs introduced at the same time as interest rate hikes, will have a detrimental effect. I think we are in uncharted territory: we may not learn what, if any, effects occur until a year or two from today.

Political Climate: We are fast approaching the Congressional “mid-term” elections, and shockingly basically 24 months from the next Presidential election (Nov 2020). History reflects that Presidential campaign activity typically begins 18 months prior to the election, so expect to see the contenders from various parties to be identified and on the campaign circuit in mid-2019. This may (or may not) be a trigger for major investors to exit stocks and move their money into safer investments, any such move would send stocks lower.

Housing Data: Data from various sources seems to reflect that housing is cooling off. Homes are sitting on the market longer than they were a year prior, surveys of builders reflect that optimism has decreased slightly, and my opinion is that rising mortgage rates may cause a continued slowdown in housing. When housing cools off, this is a semi-decent indicator of a recession ahead. Chart of 30-Year nationwide mortgage rates is below:

As always, the ultimate barometer of things is the market itself. With that said, lets look at the SP 500 Index, my preferred index to capture the heart of the stock market, since it contains a variety of NYSE and NASDAQ companies across a variety of industries and sectors:

As can be seen, the index continues to make new highs, recently attaining 2940 on Sept-21. As such, that is the new overhead resistance level, breaking thru this is an obvious positive sign. The index is well above its 50-day Moving Average, a popular trend identification tool, a positive sign.

Looking ahead, September is almost behind us- October thru January historically are positive months for stock investing. Political and economic concerns aside, the market remains in an uptrend, my personal TSP Allocation remains 50% C-Fund and 50% S-Fund. In the event I become nervous about things or contemplate changing my TSP Allocation, I will post an update here.

Thank you for reading!

-Bill Pritchard