Hello everybody

Well, the previous week brought no real progress to things, market-wise. The SP 500 indeed broke thru 1880 and touched 1891.33, on Friday May 2, in response to the “Jobs Report” released on the same date at 8:30 AM Eastern Time.

This is above my previously discussed “overhead resistance level” of 1880. However a little more is going on behind the scenes, so lets talk about it. Lets take a look at the one-day chart of the SP 500 for May 2, below, one without comments, then one with comments, before we start our assessment of May 2. It should be noted that the mainstream media is putting out that the SP 500 and Dow Jones have hit record highs, which is technically correct…what they fail to tell you is that the highs were hit at 10:30 AM Eastern time and that the indexes went lower the rest of the day. The markets open at 9:30 AM, so the indexes only lasted one hour before rolling over. So, no, people are not diving back into the markets with both feet, and sending stocks higher. Lets look at some charts:

What apparently happened, is that the worry, tension, and concern over the jobs report, was digested as “good news” initially, but then folks decided the news was not really so good as believed. The financial press, largely read by Wall Street, were quick to criticize the report, with most editorials all stating the strong assertion (multiple, different publications) that people have simply stopped looking for jobs and/or are retired-out of the workplace, thus affecting the data in the report.

Not saying one person over another is “right” or “wrong”, 288K jobs created is better than no jobs created, but in any event, opinion/right/wrong/theory/etc. do not matter, what matters is how the market itself acts and responds. Unfortunately, the jobs report euphoria lasted about one hour and the indexes rolled over and closed lower by the end of the day. (But remember the headlines, “Indexes make new highs” etc. etc.)…

Important to note is that the current unemployment rate is 6.3%, which is below the 6.5% threshold level believed by many to be the “green light” that the FOMC needs to raise the Federal Funds Rate. Furthermore, “rate hikes” are not welcomed with open arms by Wall Street, and this will cause additional indigestion for the markets. Many speculate the next rate hike will occur in Summer/Fall 2015.

Lets go back to the week itself (the title of this update is Week in Review….), before we start the discussion, here are two SP 500 Index charts, one with no comments, one with comments:

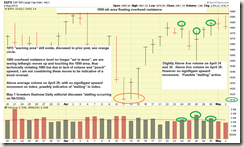

What is apparent from looking at the charts is that little volume is occurring in the indexes and we are seeing little serious upward movement, aka yardage-gained. Yes, as discussed above, we hit 1891 on Friday but now we all see that there is “more to the story.”

It should be noted that on April 24 and 30, slightly above average volume occurred on the SP 500, with a slight upward movement, and on April 28, above average volume occurred, with minimal upward movement. This is associated to a behavior known as “Stalling” or “Churning”, discussed further by Investors Business Daily (the folks who pioneered the concept) at this link. In short, stalling is when the index fails to make any decent upward progress, even though it may have some volume activity which could serve to send it upward. When this happens, it is akin to a crowded shopping mall, except in this case, the “shoppers” are not buying nor selling, they are just walking around browsing. The un-informed observer (mainstream media) would report “the mall parking lot is packed with cars, and people are filling the stores, therefore the stores must be selling a lot of merchandise.” Except, they are not.

Maybe that example does not make sense but that is my best attempt to explain stalling in the indexes. We have some volume, just no resulting action. It should be noted that many professionals consider a “stalling day” as unhealthy as a “sell off day”. AGENTS NOTE (yes I said that LOL): The “above average” volume April 24 and April 30 was nothing earth shattering anyway….

NOTE: On May 1, 2014, Investors Business Daily newspaper went ahead and affirmed that stalling was indeed occurring on the NASDAQ index. The SP 500 was not mentioned.

With that said, I remain 100% G-Fund. In the current climate, I don’t look at things as “missing opportunities”, as the indexes have not really done anything except flop around. If I miss a sudden, violent, sell-off, or worse, the start of a new bear trend, something not impossible right now, then great. Missed opportunities ? Right now, based on my optic, there is no opportunity to be had, and nothing missed.

I remain 100% G-Fund.

Thanks for reading ! Talk to everyone soon…