Hello everybody

The markets continue to behave in a frustrating manner. While new highs have been attained, we have not seen any volume that would serve as combustion for a solid new uptrend, ideally launching the markets out of the recent quagmire going back basically two months.

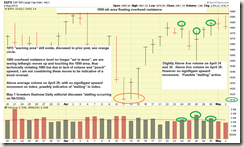

The new high made on May 13, was a “one day flash in the pan” which then collapsed lower the next day, largely due to a lack of volume to sustain things. The high made on May 23, may or may not repeat the same behavior, as it too, was attained on low volume.

What we are looking for is the following criteria before any confidence can begin regarding a new uptrend. The following criteria have been established by Investor’s Business Daily, of which I follow closely, albeit I have tweaked some of their strategies to accommodate my personal TSP and stock portfolios.

We need to see:

1. +1.7% Gain or better on the SP 500 or NASDAQ index (after the market closes for the day)

2. On volume ABOVE/HIGHER than the prior session volume.

3. Volume for the day should be ABOVE AVERAGE, ideally 25% or more.

IF all three are met, this is STILL NOT a green light to dive immediately back into stocks/stock funds. It is an “almost, darn-close, green light”, requiring us to monitor things for additional signals.

My earlier statements regarding support and resistance still stand, however, “one-day penetrations” of prior levels are not really reasons to raise the level or to suddenly delete the yellow caution flag. In other words, a few weeks ago, I spoke of 1885 as being overhead support. Well, as luck would have it, this was penetrated for a day or two, only for the trend to reverse back down. Note that almost all recent penetrations have been on low volume. As stated numerous times before on this site, volume is the “credibility” behind the move. Low volume = low credibility. High volume = good credibility (that the move will continue).

Lets take a look at a chart of the SP 500:

This indeed is challenging and frustrating. It should be noted that it takes volume to prop up, and sustain, new uptrends and bull markets. It does NOT take volume to prevent a market from collapsing under its own weight or otherwise falling apart. So in the current market climate, I remain 100% G-Fund. Yes, “we made new highs” this month, and if anybody wants to jump back in, it is me. However I think it is a very risky proposition without the volume to validate the recent moves up.

With that said, for entertainment value, I have posted a 2011 video of a Mark Cuban interview (TV show Shark Tank, supporter of Iraq War Veterans). Video is courtesy of YouTube and Wall Street Journal. Mark Cuban is no stranger to “speaking his mind” and making his stance known, whether it be the NBA or tech investing. In this video, he discusses his opinion that Buy and Hold is a Crock of S**t (time stamp 1:07) and his thoughts on being “in cash.”

That’s all I have for now. Again, my TSP Allocation remains 100% G-Fund. Thanks for reading and please share with your friends and colleagues.

– Bill Pritchard