Hello everyone

The market’s action this past week resulted in the streak of gains (six weeks worth) being paused. This is not a big deal…July historically tends to be a lethargic trading month in the markets…our July 2013 gains were really a pleasant surprise. Hence, this “pause” in the market’s uptrend is not causing me to lose sleep.

It is noteworthy to reflect that July’s gains (again, typically a lackluster month) resulted in the S-Fund being the top performer for the month, something I talked about in my July 26 post on this site.

It should also be noted that the I-Fund has indeed taken the lead over the other funds, a behavior which began approximately the last week of July and exists until now. I am not going to change my TSP allocations yet, as I want to monitor this behavior a little longer, but it is something that we need to be cognizant of. One could speculate as to why this is happening…some folks believe that the global economy is starting to strengthen, thus prompting some cautious investments in the foreign markets, and thus pushing the foreign stocks higher.

The most recent trading week, August 5-9, was marked with some nervousness after Chicago Fed President Charles Evans’ Aug 6 comments, which signaled a possible scale-back of the Fed’s financial stimulus program. The next Federal Reserve meeting is Sept 17-18, at which time we may see more clarity on that issue. As discussed previously on this site, I consider the US economy a “sick hospital patient”, and as the patient recovers, it only makes sense to reduce the prescribed medications and various life support systems which are attached to the recovering patient. Clearly some folks are worried if the patient will survive without medication and life support. However, it is better in the long term if the patient learns to breathe on his own again.

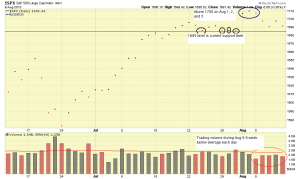

Let’s take a look at a 2 month chart of the SP 500 index, using “close only prices”, to see how things look. I am calling 1685 on the SP 500 as our support level, as all the recent market closes seem to be at or above this. I am happy to see that the SP 500 broke above the 1700 level, an area discussed in my July 26 post, as being a key overhead resistance area. This occurred on Aug 1, Aug 2, and Aug 5, and returned to sub-1700 levels after that, largely due to Mr. Evan’s comments on Aug 6. Let’s take a look at the chart:

In summary, I am still 100% S-Fund at the present time, and will monitor the I-Fund to see if a change is warranted in our TSP Allocations. Note that August and September are typically the worst performing months of the entire calendar year, so any declines during August and September may or may not be a departure from typical historical behavior.

As always, if you find this site useful or informative, please share it with your coworkers and friends.

Thank you for reading

– Bill Pritchard