Hello Folks

I hope everyone’s summer has been going well. Some trivia: The summer months of June, July, and August represent the lowest trading volumes (basically, activity) for stocks the entire year. Most major players are “out” for the summer and away from the markets. Volume remains the key “qualifier” when major moves up or down happen. If big volume is there, the move is likely the start of something, and/or the move is unlikely to reverse itself in the coming days.

With that said, the stock indexes remain in “classic” Bear mode, with the 50-day moving average below the 200-day moving average across all indexes. Let’s take a look at the S&P 500 Index below:

As can be seen, volumes are below average, and while indeed the index appears to be climbing positively since July, it is still below the 200-day moving average and faces various challenges brewing on the economic front.

Which leads to the question: Are we in a recession?

If you go back and take a look at my September 22, 2019 post, I talk about recessions somewhat. In short, most define a recession as a period in which real GDP declines for at least two consecutive quarters. Note that not one sitting President has been re-elected when a recession started on his watch, so (this is not a political commentary site, but…) it is accurate to say that some elected officials currently are wordsmithing what the country is facing right now. In my opinion, if it quacks like a Duck, walks like a Duck, has an orange bill, floats in the pond, and runs to shore if you have duck food in your hand, it is probably a duck. However this recently said animal is now being called a floating chicken, feathered pond dweller, and a quacking water bird. But not a duck, because, well…

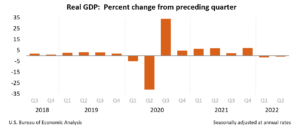

The recent GDP release, on July 28, 2022, reflects Q2/2022 GDP was -0.9% and Q1/2022 GDP was -1.6% (twp consecutive negative GDP’s).

Observing the GDP chart above, you can see poor GDP in Q1 and Q2 2019. In spring 2020, COVID hit the planet, and a variety of government funded relief packages and incentives came into existence. GDP recovered. However did the chicken, or the egg, come first? Is today’s economy loosing steam because the COVID pandemic created “pent up demand” for travel, gas, and housing? Prices, based on supply, going through the roof, resulting in the Federal Reserve raising interest rates, to cap spending, which has then triggered where we are today? Houses sitting unsold for weeks versus hours? Etc? Interesting conversation but beyond the scope of this post.

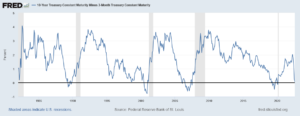

The Yield Curve, has been flat recently and near inversion, which very commonly is a predecessor for a recession:

A good article about inverted yield curves can be found here, however the short version is that this is a very reliable recession predictor.

All of this, to include my retired status, has caused me to remain 100% G-Fund. Take a wild guess as to which fund has the best rate of return recently?

It would be the G-Fund. In other TSP news, a new TSP Mutual Fund Window feature is active, however TSP investors are apparently slow to embrace it. I wonder why, having to decide between the C, S, and I fund is hard enough as it is. Now the TSP investor can potentially invest in 5,000 mutual funds, from 300 different fund families. If you thought determining if small-caps would outperform large-caps was difficult, try using your crystal ball on the New Centurion Large Cap Growth Fund versus the Gladiator Large Company Global Opportunities Fund.

That is all I have for now, in my opinion we are in a recession-like climate, we indeed are in a bear market, and various headwinds exist in the near future.

Thanks for reading, take care…

-Bill Pritchard