Good Morning Folks

Bottom Line Up Front: Today, Saturday morning, I have submitted a change to my TSP to reflect 50% G-Fund and 50% S-Fund (contribution allocation and interfund transfer). Let’s talk about this and in the course of doing so, I will share my personal opinion on a variety of things facing both the markets and the economy in general.

Note that the above change comes a little more than a year since my last move, which was 100% to the G-Fund, on October 23, 2018. As I have discussed in prior posts, my goal is not to day-trade my TSP (good luck with that) but to capture long term trends up when both the technical picture (charts, volume, stock market behavior) and the fundamental “backdrop” (economy in general, financial climate, etc.) reflect a climate indicative of future gains.

The above allocation is not “all in” 100% into stocks, I am basically putting one foot back in the water for now. Let’s be honest: the economy indeed has some challenges ahead, to include the ongoing, still unresolved tariff war US/China, interest rates being reduced as “insurance cuts” to counter contamination from weakening global economic considerations, and ongoing riffs, battles, and disputes in the world of politics.

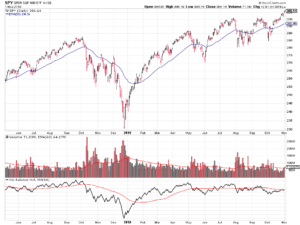

Some may recall I often say that “the market knows all” – indeed it does, and despite numerous setbacks, delays, wordgames, etc from China in regards to a trade agreement, the market has shown resilience and gone up. Volumes have been weaker than desired, but we have had numerous days of back-to-back “up volume” albeit lower than average volume on each of those days. I have basically watched the indexes go up all year, and gotten beat up about “missing gains” – I get that, but my personal investment methodology includes discipline and avoiding emotion (for the most part) in my process. Lets take a look at a chart of the SPY exchange traded fund, a useful proxy for the SP 500 Index:

An important observation is the market has attained All-Time-Highs as of Friday November 2. If you have followed earlier posts, those who adhere to a technical analysis approach (like me) will conclude that this is a positive sign and that there is no “overhead support” for the index to “fight thru” in order to climb higher. It also made all time highs on Oct 28 and Oct 29.

Fueling this uptrend appears to be the reversal of the inverted Yield Curve, an oft-used signal for a recession, and an apparent acceptance that no solution to the US/China trade dispute is near. The Yield curve returned positive on October 10, as reflected by the below charts:

A glance at the 20 year chart will support the notion that the yield curve indeed was inverted/negative in times of market crashes. The facts are before your eyes in the chart.

In summary, I am 50% S-Fund and 50% G-Fund in my personal TSP. I may go to all stock funds in another month or two. I think that is enough reading for a Saturday morning…thanks for being a subscriber. Let me reaffirm my respect and support of retired FBI S/A (current CPA) Dan Jamison’s FERS Guide, he is a very knowledgeable expert in regards to federal retirement, especially for the 6(c) law enforcement audience. Retirement benefits, life insurance, survivor/beneficiary rules, these are all answered by Dan and his FERS Guide which I encourage you to sign up for. When I have questions, I talk to Dan.

I appreciate the readership and support of this site, where I share my personal opinion and analysis of stock market action and factors affecting the TSP. Please share this site with your friends and coworkers. Thanks for reading and have a great weekend….

-Bill Pritchard