Good Afternoon Folks

Hope all is well…today is Nov-19, and we are approaching the customary two-week mark after my last update on Nov-8. Time to push out a new update in light of the Thanksgiving Holiday coming up. Note that this is my first post-election post.

First (or BLUF as some would say), I remain 100% G-Fund. I have received some “inquiries” (nice way of saying it…) as to my logic, in light of a pretty strong rally post-election, so maybe on today’s post I can explain things a little bit more.

The reader may recall my pre-election analysis, and my accurate and correct prediction that Donald Trump (DT) would win the election, a prediction which was published on Nov-8 at approximately 10:39 PM Central Time, and “against the odds” as reported by polls and major media outlets, who prophesied that Hillary would win. As DT scored wins during the night, the Dow Jones Futures plummeted and Miley Cyrus sobbed. Note that since Nov-2, I had been tucked safely into bed via the G-Fund. Let’s take a look at the charts after the election:

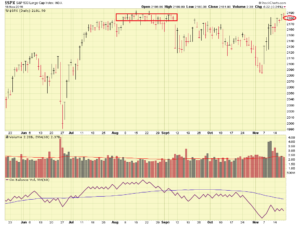

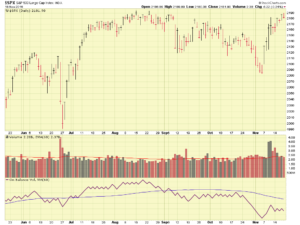

While we saw a pretty big rally the days after the election, things kind of subsided a few days afterwards, with volume declining. Note that a 1.7% Daily Gain or greater, on above average volume, is needed, on the broader market indexes (Dow Jones, SP 500, NASDAQ), to really change the direction of the markets. We did indeed have above average volume, but we did not have the 1.7% gain. Also, my benchmark “market health” index, the SP 500, is basically in the same place today as it was in August, aka the 2180 area. See chart:

With all of that said, one may conclude I need to be more positive and embrace the Christmas Spirit, and wish for TSP cheer this holiday season. Fear not, as I have plenty of reason to do so: With DT elected, we have the potential for reduced regulation in all aspects of life, which will help business growth and expansion. DT is apparently surrounding himself with folks with very strong resumes, and may be a subscriber to the “surround yourself with smart people, and turn them loose” theory of management. With a Republican President, a Republican Congress, and some new agency heads being ex-Congressmen, one would think we can finally get something done in Washington.

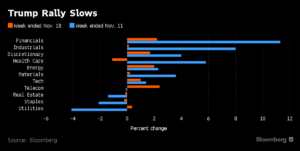

Note that the stocks that rallied after the election were mostly all Dow Jones index components, I called this the “Trump Index” because everything else was flat. The industries that rallied, per Bloomberg, are evident in this graphic:

The currently top sub-sector of the market is the Small Cap stocks, aka S-Fund, which indeed zoomed higher so far, since Nov-8. However this is the same index that can crash hardest, if this rally is short-lived. For those who are in the S-Fund, congratulations to some well deserved gains. However, in my opinion, caution is the word of the day, as DT chooses his team and the market digests the new administration, which does not even begin until Jan 2017. In other words, if the market is beginning to tick upward now, we may have a great next four-years.

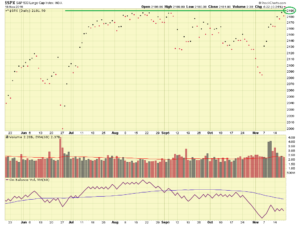

I am closely monitoring the SP 500, I want to see a close price of above 2190, and I want volume to get a little stronger. See chart:

2190 is an important resistance level, the good thing is, is that I think we can breach it soon. If that occurs, and if volume starts to pick up, I will likely exit the G-Fund and return to stock funds. Until the market itself tells me otherwise, I will remain in G-Fund. Expect light trading volume next week due to the holiday, market will likely be flat. FYI

That is all I have for now, Happy Thanksgiving and safe travels !

-Bill Pritchard