Hello Folks

Well, last week we saw the markets rise, however volume on each “up day” was less than the prior day’s volume, classic signs of a rally with no steam. Most rallies with any chance of lasting have strong volume behind them, and such volume tends to rise or be greater than the prior “up day”. We are not seeing that right now. Also, due to the price action on the SP 500 Index, we have a pending 50-day Moving Average and 200-day Moving Average crossover, which for some is considered an additional bearish signal. For me, I have enough “go to the sidelines” signals, and I am in G-Fund.

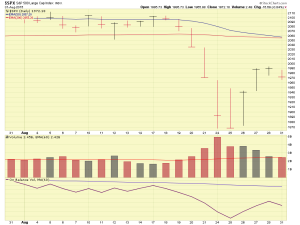

Let’s look at some charts:

If we take a look at the above chart, the red arrow reflects the downward action of the Index, it is accompanied by rising volume, “backing up” the potential that the just-occurred movement (downward action) is strong (versus weak) and likely to endure (versus not endure). The SP 500 Index finds a bottom in the 1870 area then on August 26, rallies higher. For those who do not understand the importance of volume, many believed that “the storm clouds are behind us” and many talking heads on CNBC proclaimed that the market was back on track, having just “hiccupped” days earlier. Others, like me, who study volume, were concerned with the high volume on the prior down days, and started to observe that the volume each “up day” was lesser than the prior “up day”. Notice that while yes, the market did go up, on Aug-26, 27, 28, the volume went down. Poor volume “reduces the credibility” of any potential reversal, with reduced probability that the perceived rally will endure.

Over the weekend, I also concluded that the only thing causing rallies, weak ones or not, was super positive headline news, and not the result of normal inflows into investments. Absent super headline news, (such as reports that the Chinese government themselves were now buying zillion dollars of Chinese stocks) the markets fall apart a few days later. A general “cloud” of worry seems to cover the landscape, and volatility is at record levels. Note that in my opinion, the FOMC is not going to consider the stock market’s performance or what is happening in China, as part of their rate increase decision process. It is also my opinion that we do not see a rate hike in September, but not because of China or the markets. Furthermore, my opinion is that the previous well-intended plain vanilla FOMC statements are leaving the markets jittery, as they seek more clarity and try to determine the direction the FOMC is headed.

Poor and flawed information pushed out in the financial press, to include reports that “this is a standard correction”, are not helping investors. I don’t recall 1000 point losses in one day (in mere minutes), nor mid-day White House Press Secretary live appearances to soothe investors, in “standard corrections”.

During the evening of Monday Aug-31, BBC Business released a report that China’s economy is indeed slowing down. Nighttime Dow Jones Futures are trading 250 points down. This is not the mark of a positive regular market day for Tuesday Sept 1, the day following a triple digit (115 points) loss on Monday. The week is not exactly getting started well. See chart:

In summary, my balance remains 100% G-Fund. I lost a little on the way thru the exit door, but my account is protected from additional damage.

Let’s keep an eye on things this week. Until then, take care and talk to you soon.

– Bill Pritchard