Hello Folks

Last week I just didn’t bother posting, as I expected the Greece situation to be all over the map (no pun intended) with yes/agreement, no/agreement, etc etc. The Greek Finance Minister tweeted how “he will be standing strong” (or similar language) then like two days later, CNN was reporting he had resigned. Depending on what news channel and what time of the day, it seemed another Greece version of events was playing out. I almost just turned off all media last week, except for the Shark Tank on ABC.

With that said, the markets are indeed in stormy seas. I am sticking my neck (and my TSP balance) out on a limb somewhat, this is “in line with” my previously discussed stance that I would reduce my jumps into G-Fund (a result of some tweaks to my system). As such, well, here I am, still S-Fund. Lets talk about that and what is happening in the markets, as many have asked me why the markets are so volatile.

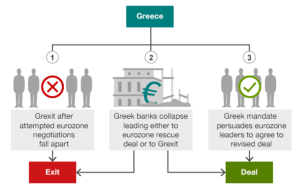

Greece: It has been said that the true, 180 degree reversal and “wake up call” for an addict is when he hits rock bottom. This means a drug addict may “get it” when he wakes up, homeless, under a bridge, in the cold rain, shivering, with the only thing to warm him being a memory of his 5-year-old boy who his mom is raising by herself, in a house with changed locks. That addict may say, gee, this sure sucks, I need help. Well, Greece has been an addicted to loans and other people’s money, and refused help via fiscal reforms, cultural changes, and a display of cooperation with lenders. (I have ranted on this, ad nauseam, in previous posts…). With the IMF’s hard stance and holding Greece to the fire, Greece appears to be hitting rock bottom, and is waving the white flag. A possible, maybe, possible deal may be in the works between Greece and neighboring countries, many of whom have huge loans out to Greece, namely France and Germany. See below graphic, from BBC, outlining probable scenarios:

There is huge pressure on Greece to “pull their head out” and present a plan forward. Open source internet reporting reflects the following upcoming dates as being important or Greece entire banking system will shut down and an expulsion from the Eurozone (they are still in however for not much longer…).

- Thursday 9 July: deadline for Greece to submit proposals

- Saturday 11 July: eurozone finance ministers meet

- Sunday 12 July: all 28 members of the European Union meet to decide Greece’s fate

- Monday 20 July: $3Bpayment due from Greece to the European Central Bank

So, long story short, the IMF is giving Greece a “last chance deal” this week, and after Sunday July 12, Greece is either in the Eurozone or not.

Market Behavior:

“2040” has become our new support level for the SP 500, my overall benchmark index of the stock market since it represents five hundred large cap, major companies, all invested in by major mutual funds and retirement plans. 2040 is a round number which is psychologically important for traders. Lets take a look at two charts, first with no graphics, second with the 2040 area circled, in March 2015 when it was touched, and recently, where it was almost touched, this week:

Apparent is that a penetration below 2040 (the index goes to 2038, 2035, etc) is a negative and indicates additional weakening of things. A move to G-Fund will become likely if this occurs.

In addition, the recent Federal Open Market Committee (FOMC) minutes were released, and the FOMC is expressing concern about Greece, while expressing satisfaction with the current economy. A rate hike is not expected until September. My personal opinion is no rate hike until 2016, but I have been wrong before. As we get closer to September, the market appears to get more nervous, now add Greece into the mix, and welcome to the current situation.

Investors Business Daily newsletter, a trusted source of information that I back my own analysis with, is considering the current market to still be “uptrend”, so I am not the only optimist.

That is all I have for now. Thank you for reading and please continue to share with your friends and coworkers.

I remain 100% S-Fund until further advised.

– Bill Pritchard