Hello Everybody

Well, mom used to tell me that “if you have nothing nice to say, just don’t say anything at all” and her advice applies to the markets as well. Sadly, I have no positive news, since my last post which occurred April 13, in which I advised that I was moving 100% to G-Fund.

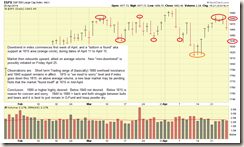

Since then, the markets have really done nothing. Sure, they trended up, on average volume, and just as everyone was thinking about getting back into the action, on Friday April 25, the markets closed lower, with the Dow Jones Index down 140 points for the day. Potential reasons (I hesitate to crystal-ball the markets) offered by mainstream media continue to be the Ukraine crisis, and some less than stellar earnings reports coming out of corporate America. However, in the end, we have to follow the market itself, and with that said, here are some charts of the SP 500 Index, and SP 500 Futures (white chart), both without comments, then with comments:

Lets take a look at the action since my April 13 post. From April 11 to April 15, the SP 500 Index (as discussed numerous times before, this is my “go to” barometer of market health) “found a bottom” (aka support) at basically the 1815 level. It then proceeded to rebound upwards off 1815, however the volume was average volume on almost all days. To really kick-start a new uptrend or break thru the frozen ice layer above us, I like to see above average volume, ideally 25% above the average volume, behind any new upticks in price. This of course never happened and the index indeed went up, but on average volume.

April 22 to April 24, the index met overhead resistance at the 1885 area. For the purposes of my ongoing analysis, I will continue to use 1880 the observed overhead resistance level, and 1840 as the support level. Action between 1840 and 1880 appears to be akin to chasing a ping-pong ball around and attempting to predict where it will bounce. So basically, I am only interested in action outside of those levels. Let me clarify that, any action within those levels but occurring on above average volume, we need to pay attention to. Note that 1815 is indeed a number to watch, as the market touched on it but bounced back up. Any action below 1815 is clearly a negative.

Some recent “high fliers” in the market have taken some blows lately, to include Facebook (FB), Amazon (AMZN), NetFlix (NFLX) and the Biotech sector. Observe that these stocks are all NASDAQ stocks, and as such, the NASDAQ index will reflect a little more pain than the other indexes. Time will tell regarding how these stocks perform. Individual stock selection is not the focus of this site, there are hundreds of sites and information sources out there which offer such services. Monitoring the markets and the TSP is hard enough.

The evening April 27, SP 500 futures are trading rather flat, unable to trade higher than the prior session high, which would be April 25 session. This may indicate that the Monday April 28 daytime action in the regular markets may be listless or a down day.

My TSP Allocation remains 100% G-Fund, as I prefer to “keep my powder dry” right now, and I see no signals or indications that moving to the stock funds would be a profitable thing to do right now.

Quick Re-Cap: 1840 to 1880 is to be disregarded UNLESS the movement is on above average volume. Chasing the index in this area is like chasing a ping pong ball. Ideally we get back above, and remain above, 1880. Below 1840 is not desired. Below 1815 is worrisome and troubling.

I don’t know if I am “buying” the media’s theory that the markets are down due to Ukraine. Gold Prices (Gold is the “safe haven” investment) are lower, and Crude Oil prices are lower, than they were a few weeks ago. Gold tends to rise, in times of political instability / war / etc, and Crude Oil, due to perceived supply disruptions due to war / combat actions, historically, will rise also. See charts:

Not that Russia v. Ukraine is Iraq v. Kuwait (from an oil supply perspective) but the point is this: Crude and Gold are LOWER, not higher, than they were a few weeks ago, meanwhile the Ukraine/Russia situation has reportedly worsened. What this means is that the markets may be going down for other reasons, which is more of a concern for me, than the theorized-temporary mood swing out of Ukraine nervousness.

Lets keep our fingers crossed and see how this week turns out. Thank you for reading and please share my (your) site with your colleagues.

Talk to everybody soon…

– Bill Pritchard