Hello Folks and Happy New Year

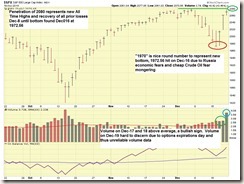

2014 trading is now over, with December 31 being the last day of trading for the year. Unfortunately, the markets closed down today, with the Dow Jones Index down 160 points. The SP 500’s December gains were erased as a result of today’s performance. Volume was higher than prior day, but still below its average trading volume, obviously a result of many market participants being out of the game for the holidays. However I would have preferred an “up day” on the last day of the year, versus a down day. Investors Business Daily is reporting six (6) Distribution Days on the SP 500 within the last few weeks, which is a negative sign. Some observations:

2014 Close-out observations

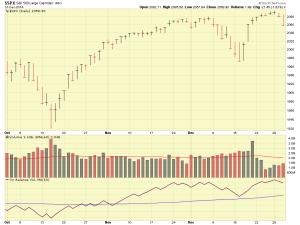

Here is a chart of the SP 500, without comments, my primary graphics program is Window’s based and I am on Annual Leave with my MacBook, and have yet to “master” the MacBook graphics editing software I have installed.

Some positive observations are the SP 500 closed out 2014 up 11% for the year, notwithstanding quite a bit of turbulence throughout the year. Small Cap stocks (S-Fund) will likely come in as top performer for December, and out performed the last three months, according to my analysis. I-Fund underperformed both the C-Fund and S-Fund for the year, not a huge surprise, due to various international flare ups and global economic issues.

Another positive observation is the “2080 level” on the SP 500 was broken on December 23, reflecting the market’s desire to seek higher altitudes, a positive sign.

Note that the first trading day of the year, Friday January 2, is sandwiched between Thursday (New Years) and Saturday, and it is unlikely we see any huge market volume that day. With that said, an “up day” is preferred versus a down day, as the first day of the year “sets the tone” for the mood and sentiment of the market. I remain 100% S-Fund.

2015 Observations and Challenges Ahead

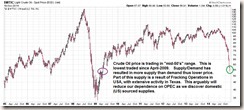

As stated above, the first trading day(s) of the calendar year “sets the tone” for the rest of the year. So we need to monitor that. In addition, Crude Oil continues downward, it is currently trading at $53 a barrel level. See chart:

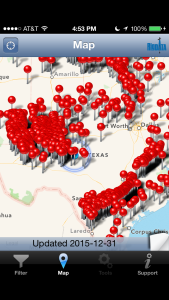

While “cheap gas” is good for consumers, Mom and Dad who are deciding to top the minivan fuel tank and take that road trip or not, depending on what circle you ask, it may or may not be bad for big business. I sat down and had lunch recently with a close friend who is employed in the Oil and Gas exploration industry in West Texas, he felt that $70 a barrel crude oil was the magic number so everyone makes money but fuel is not super expensive for the end consumer. West Texas exploration, to include fracking, has slowed down significantly, and as we enter 2015, Oil and Gas (aka “ONG”) companies will be re-assessing 2015 projects. Lets take a look at the screen shot of my iPhone Rig Data app, which shows oil rig activity in proximity to your GPS location. The red pins represent an oil rig.

While “cheap gas” is good for consumers, Mom and Dad who are deciding to top the minivan fuel tank and take that road trip or not, depending on what circle you ask, it may or may not be bad for big business. I sat down and had lunch recently with a close friend who is employed in the Oil and Gas exploration industry in West Texas, he felt that $70 a barrel crude oil was the magic number so everyone makes money but fuel is not super expensive for the end consumer. West Texas exploration, to include fracking, has slowed down significantly, and as we enter 2015, Oil and Gas (aka “ONG”) companies will be re-assessing 2015 projects. Lets take a look at the screen shot of my iPhone Rig Data app, which shows oil rig activity in proximity to your GPS location. The red pins represent an oil rig.

Immediately apparent is the extensive drilling activity in Texas, especially near the Big Lake, TX and Carrizo Springs, TX areas. While this does not directly impact your TSP balance, I feel this information sheds some light on the oil production going on in our country, as our domestic companies try to deliver product to the end-user while seeking to keep the Supply/Demand equation in balance so that prices are not too cheap nor too high.

Additional challenges we face are the interest rate hikes expected in summer/fall 2015, which may reduce lending and business activity, which may then affect other things. Note that historically, markets never have positively respond to interest rate hikes, so expect some turbulence in response to this, up to and including a new bear market as a worst case scenario.

One more challenge is the fact that the current bull market is very mature, being six (6) years old now. So we are “due” a correction/bear market, it is just a question of when.

With that said, I remain 100% S-Fund. We had tremendous subscriber growth in 2014, thanks for the interest and support. I get a lot of cool emails and appreciate all of them. Please continue to share this site with your friends and coworkers. I wish everyone a Happy New Year and see you in a week or two with another update. Thank you !

– Bill Pritchard