Hello Everyone

Unfortunately 2015 is off to a poor start; my last post discussed the fact that the first trading day of 2015, Friday Jan 2, was sandwiched between Thursday Jan 1 (a holiday) and Saturday Jan 3 (market is closed). Jan 2, not shockingly, saw very little market volume however nonetheless closed down. The first trading day of January is symbolic as it tends to “set the tone” for things to come. Then on Monday, January 5, arguably the first trading day “operationally speaking”, due to the New Year’s weekend now past, witnessed the Dow Jones closing down 330 points. Then Tuesday, January 6, the Dow Jones closed down 130 points.

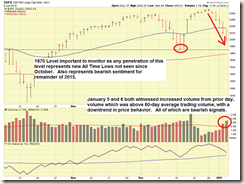

While I am the first guy in a crowd to try to look for the positive when surrounded by bad news, I admit there just isn’t anything positive so far this new year from a market standpoint. I would prefer flat or lethargic action versus back to back down days, on above average volume. See charts, first those with no comments, then with comments. Note my primary analysis tool remains the SP 500 Index.

Long story short, my finger is on the trigger guard for a move to G-Fund. Barring exigent circumstances or a compelling story in the background, I will likely go to G-Fund if the SP 500 penetrates below and closes below 1970 on the index. I of course will update this site as needed. Observe that the “market knows all” and at the end of the day, “price is all that matters.” In other words, it doesn’t matter what theory or opinion exists as to why things are happening, what matters is what is happening. For further insight into my belief system on this, take a look at my March 2013 post, titled Buy and Hold is Dead, which generated quite a bit of positive emails from readers.

With that said, it is often useful to have an understanding of the forces in play behind the market’s movement. Just remember to respond to the market itself, and not news stories or talking head experts on cable news. A few things to be aware of:

– Oil Prices at all time lows, currently $50 per barrel: Some energy companies are starting to lay off workers due to reduced exploration activity in 2015. Also, OPEC (by the way when you have some time, take a look at who the members of OPEC are and try to count how many are clearly US allies) appears to be displeased with our successful domestic oil exploration and appears to be playing the game of who can hold their breath longer. In other words, our exploration has caused (in my opinion) supply to go up, and drive price down, displeasing OPEC, who now has decided to not turn off their spigots and thus send the price lower (more supply coming into market), thus causing pain and suffering to the very US energy companies who facilitated or directly influenced the domestic exploration in the first place. Once these “evil companies” are snuffed out, OPEC may turn the spigots off again, let demand consume the supply, and thus the prices will resume upward. Call me a conspiracy theorist but that is my opinion.

Oil chart, with comments, below:

– Greek Parliament elections planned for January 25: Yes, it is “them again” aka Greece, affecting the markets. As some may recall, the International Monetary Fund (IMF) and European Union (EU) previously agreed to assist with bailing Greece out of its financial problems, however the SYRIZA Party, a leftist party, is favored to win Parliament on January 25. The leader of this party wants “debt restructuring” which basically means he wants to call MasterCard and tell them the agreed-upon agreement ? Nah, I just decided it will not work and I don’t want to abide by it. This is a dangerous action, and most of us have seen what a political party can do, aka Hugo Chavez/Venezuela or Evo Morales/Bolivia. Basically anything they want to do, to include re-writing their Constitution. This situation bears watching.

– Republican control over Congress: As of January 6 2015, the Republican Party has complete control over Congress, led by Mitch McConnell and John Boehner. While this did not cause the Dow to go down, it is fruitful to watch because historically the markets do best under a Republican Congress and a Democratic President. The good folks at the Hirsh Organization discussed this on page 101 of The Almanac Investor. The same folks have conducted extensive research on the “January Barometer” and “January Effect” both of which have proponents (I am one) and naysayers. At this point, it is not known if Republican control over Congress will positively impact the markets.

– Remember that the markets are a leading, not lagging, indicator: This statement always generates some email traffic, and a Google search will return umpteen thousand theories, however my belief is that the markets stall out before major economic news of reflecting a recession/depression or worsening economy. They also go up far in advance of news/reports of a recovering economy. So our current action may be the harbinger of negative news in 12-18 months. Remember we have almost guaranteed interest rate hikes summer/fall 2015.

– In the “Other” category: I am mostly a technical analysis investor, with some fundamental theory, while others are all fundamental analysis. A technical guy believes “it is all about the price”, a fundamental guy believes it is about “valuation” and “worth” and “future earnings” etc. stuff. Which is all fine and good, in the academic confines of business school. So this guy and I engage in an email discussion on which school of thought is “valid” (similar to which religion is “valid”). Long story short, I told him fundamental analysis is akin to valuing an antique muscle car (Pontiac GTO) merely by the sum of its component costs. Four rubber tires cost X, the carpet costs X, the metal in the body and bumpers are worth X, thus, according to fundamental analysis, this muscle car should only be worth X. However, I pointed out that in an auction environment (the stock markets are indeed auctions), the price of this car is irrespective of component costs, it is based on the emotion, sentiment, and perceived value by the bidders, who will likely run the price up high enough until it is sold. After I explained it that way, this guy stopped emailing me.

On that note, I remain 100% S-Fund but a move to G-Fund may be necessary to stop further bleeding and prevent additional damage.

Thanks for reading…

– Bill Pritchard