Howdy Folks (Texas A&M-speak for hello) –

May is off to a poor start, unfortunately the specter of inflation continues to loom ahead, resulting a a still-sideways / lack of direction on most of the indexes, the S&P 500 as my primary barometer. BLUF: I personally remain 100% G-Fund. I have had people stalk me and track me down and beg me for hypothetical scenarios. So my “if I was not retired and I could tolerate some risk” TSP might be 50% I-Fund, 50% G-Fund. This is not advice, guidance, suggestion, or anything regarding what you should do. Consult outside expert guidance, from a financial professional. If I was, for example, 37 years old, with 20 left to go until age 57, my present allocation might be 50% I-Fund and 50% G-Fund, to capture the gains seen in the international stocks. Ukraine, general global instability, doctored economic news from China…that could all change the I-Fund’s performance. Now, let’s talk about the markets.

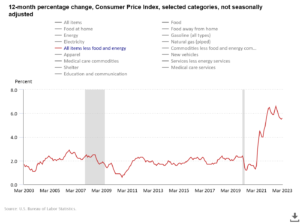

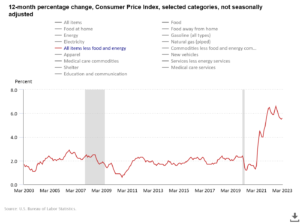

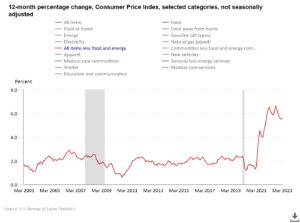

You are sick of hearing about it, but inflation, and interest rates, remain the core of the market’s challenge. You can use the search box if you suffer from sleep disorders and wish to read my numerous prior posts about this, however when inflation is too high, the Federal Reserve typically raises interest rates to slow the economy and bring inflation down. When inflation is too low, the Federal Reserve typically lowers interest rates to stimulate the economy and move inflation higher. Inflation is measured by CPI, and PCE (again, search box if you want to quickly fall asleep). With that said, CPI inflation is still at record levels:

The most recent reading, for March 2023, came in (Core CPI, CPI minus fuel and food) at 5.6%. In the event the May 10, 2023 Core CPI number is not improved, the markets will continue to decline. (Any improvement will likely cause the markets to rally and thus serve as a possible foundation to finally change the trend of the markets).

The most recent reading, for March 2023, came in (Core CPI, CPI minus fuel and food) at 5.6%. In the event the May 10, 2023 Core CPI number is not improved, the markets will continue to decline. (Any improvement will likely cause the markets to rally and thus serve as a possible foundation to finally change the trend of the markets).

Oil prices, ($75 a barrel) are reflective of consumption of oil (planes, trains, automobiles). Which means lower prices (in most cases) means consumption is down and the economy may suffering. Please see crude oil chart:

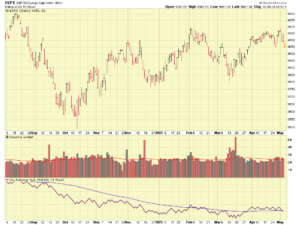

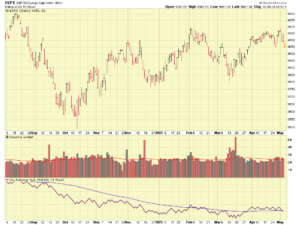

Ultimately, the market itself is our ultimate benchmark. The S&P 500 has had difficulty “penetrating” the 4200 level, which is the overhead resistance level. With no vertical trend to ride, there is no reason to “roll the dice” and be exposed to risk that the index could go back down. See charts:

With that said, some important dates ahead, all of which may move the markets, include the following:

May 10, 2023: CPI inflation report

May 25, 2023: GDP report

May 26, 2023: PCE Inflation report

As of now, I remain 100% G-Fund. Neither the market, nor the economy, have given me reason to go anywhere else, given my retired status and risk tolerance. See above for my thoughts if I was not retired or had a different risk tolerance. Remember, I did not invent, create, pioneer, or patent the use of the G-Fund as a way to protect my investments from loss. The official TSP site itself talks about that, at this link: https://www.tsp.gov/funds-individual/g-fund/

At the end of the day, do what is best for your situation.

Talk to you soon…

-Bill Pritchard

Note that the lowest number this year was in February, coming in at 5.5%. In my opinion, if April is not 5.5% or below, then the argument that inflation is subsiding, and thus interest rate hikes should slow, is out the window. In other words, a Core CPI above 5.5% will in most probability send the markets further down. Perfect world, we see 5.4% or lower.

Note that the lowest number this year was in February, coming in at 5.5%. In my opinion, if April is not 5.5% or below, then the argument that inflation is subsiding, and thus interest rate hikes should slow, is out the window. In other words, a Core CPI above 5.5% will in most probability send the markets further down. Perfect world, we see 5.4% or lower.