Hello Folks

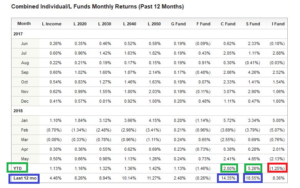

As we enter in the final stages of June 2018, a quick mid-year check of the TSP Funds reveals that the C-Fund and S-Fund are the top performers, on both a Year to Date (YTD) and a last 12-months look back period. Past performance is not an indicator of future results. As you are aware, I have been 50% C-Fund/50% S-Fund since December 2017, and am quite pleased with my TSP results so far. Note: The S-Fund is the #1 performer, and will likely remain the top performer in the coming months. I am not 100% S-Fund, as I believe some opportunities exist in the large cap stocks, and thus I desire some “exposure” over there. 2018 has been very volatile- interest rate hikes, saber rattling by heads of state, tariff talk, disagreements between elected officials, they have all caused nervousness in the markets this year. The I-Fund is the only stock fund that is negative Year to Date.

Here is a graphic of the TSP Funds performance:

Readers will recall my apprehension about international markets, something I still have presently, they will also recall my assertion that our current administration’s policies, regulations, and approaches to the economy should benefit domestic stocks more than international. All of that has occurred, and my opinion is this will not change for the foreseeable future.

The top performing index is the NASDAQ, which also contains most of the small-cap stocks which the S-Fund is correlated with. Lets take a look at a chart of the NASDAQ:

Evident is the fact that the index is near “All Time High” status, which was attained on June 20, 2018, when 7806.60 was reached. This is welcome performance, as the markets historically are negative in May and June. July is historically a positive month, lets hope that history repeats as we enter July in seven days from now.

Some have approached me and asked if the “Trade War” and “Tariff Talk” is something to be concerned about. July 6 is the implementation date of the first tariffs on Chinese imports. President Trump also desires to place tariffs on imported European automobiles. While it is not known if these tariffs are rooted in economic theory, rewarding voters, or are associated to ongoing disputes with both France’s President Macron and Germany’s President Merkel, there is no doubt that the financial press loves these topics and indeed it has caused consternation by many.

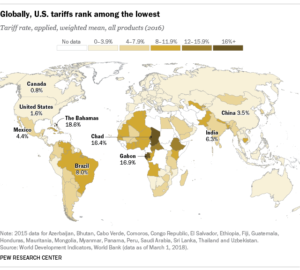

My opinion: Our current tariffs on imports are among the lowest in US history, and globally the US has some of the lowest tariffs of any country. Increasing our tariffs is not a show-stopper for the global economy. See image:

“Retaliatory Tariffs” levied against the US, while not desired, will not hurt as severely as the financial press reports (my opinion). I doubt we sell many Buick Enclaves or Ford Focus models in China, or Frankfurt, so tariffs directed against US auto sales overseas may not be as deterimental to our economy as many believe. It is important to remember that three states voted for President Trump in the last election, all three were critical for his win: Michigan, Pennsylvania and Wisconsin. All are have economies based largely on auto, steel, agricultural and textile manufacturing. So why the tariffs ? Only one can speculate, but with a sound economy in the backdrop, unemployment numbers at historical lows, and the continued strong performance by small-cap stocks, my recommendation is “buckle up” but there is no reason I can see for me to change my TSP Allocation.

In “Retirement System Changes News” category: Things have been relatively quiet since we saw various proposals get released regarding our retirement. I remain firm in my position that many of these changes will not be possible, without a re-write or change of federal law. It is more doubtful in my mind that this could affect current employees. Some are concerned about “High-3” versus “High-5” (again, doubtful this will happen…) but many are already capped out and/or have been at their pay grades for years now, the calculation of High-3 or High-5 should not impact a GS-13-Step 10 who has been a Step 10 for many years. In my opinion, it is doubtful that this will pass. Benefits talk is outside my wheelhouse, sign up for Dan Jamison’s FERS Guide, he is the expert on that topic.

I spent some time cleaning out old emails, as many know, this website has its roots in an “email list” that a lot of my friends and coworkers were on, since the mid-2000’s. I probably had 50 people on that list (which became unmanageable). Ten years ago (time flies), pre-2008 Financial Crisis, I sent the below email, discussing the G-Fund (prior emails before that date also discussed the G-Fund). Remember, my opinion is that you should consider investing in the G Fund if you would like to have all or a portion of your TSP account completely protected from loss.

Attached is a screenshot of that email, and a graphic of the SP 500:

Hopefully, we don’t see another Financial Crisis. For my long time (and not so long time…) subscribers, thank you. Please continue to share this website with your friends and coworkers.

That is all for now, I remain 50% S-Fund and 50% C-Fund in my personal TSP. Hope everyone’s summer is off to a great start, hard to believe we are approaching July already. Talk to you soon.

-Bill Pritchard