Hello Everybody

Note: My TSP Allocation/Contribution remains unchanged. I am closely watching things and yes, my fingers are closer to the G-Fund button than they were before, however I have changed nothing.

The last two weeks have been quite turbulent. We witnessed thousand point swings on the Dow Jones index, panicky financial headlines and fear mongering by the press, and more importantly, account balances and portfolios being damaged. Bloomberg Press recently published an article mentioning how the reason behind the selloff is not identified:

Indeed, depending on what channel you watch or which expert you listen to, the theories abound. I would not get too wrapped up in theory but instead stick to objective, identifiable market behavior and economic data. The markets indeed went down, that is undisputed. Allow me to share my opinions on things and it should become apparent why my comfort level is still (mostly) unshaken.

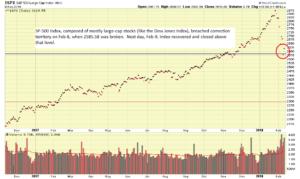

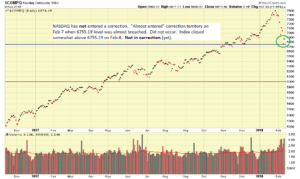

Let’s begin our discussion with the idea, shared by most on Wall Street, that a “Correction” is a 10% minimum decline (from a peak, or high) in an index. Also lets identify that a “Bear Market” represents a 20% minimum decline, and is also reflective of a new, sustained, downward direction in the markets. Bear Markets typically last six months to 2 years, Corrections typically last anywhere from one to 12 weeks. Recent volatility requires tightening up the seat belt and putting the tray tables up, but occasional turbulence is not abnormal. “Are you telling us that 1,000 point swings in the Dow is normal?” No, I am not, but as I discussed in my prior post, look at daily percentage losses, not point swings. Also, keep in mind the Dow is 30 stocks. Do 30 stocks represent the entire stock market, and health of the economy ? In my opinion no.

Surprisingly, if you use “Close Only” prices which eliminates intra-day volatility, no indexes are currently in correction territory. The NASDAQ got close, but never entered it, and the SP-500 and Dow (both containing large cap stocks) touched it briefly but exited on Friday, Feb-9. Many feel that “closing prices” better represent sentiment, as that was the last price before traders went home for the day. In my charts, the 10%/Correction level is a horizontal blue line. The 20%/Bear Market level is a horizontal red line. Lets look at all three indexes:

Theories aside, my opinion as to why this is happening is:

- 10-Year Treasury Yields reaching 3% Level

- Fears of interest rate hikes by FOMC

- Concerns about inflation

Lets take a look at the Treasury Yield chart, indeed it is on a steady climb. Many believe that 3% is an important psychological level. Yields above this fuel fears of interest rate hikes by the FOMC, who will meet in March.

Under new FOMC leadership, a new metric may be used, but under prior FOMC Chairperson Janet Yellen, the FOMC has used 2% PCE Inflation as the trigger point to consider raising rates. This is discussed in my March 11, 2015 post here.

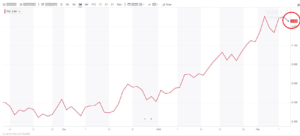

It should be noted that when inflation is feared, and when stocks go down (dare I say in a “bonafide move down”), Gold Prices (Gold=Inflation hedge and safe haven currency) typically will go up. This has not happened, while ostensibly the world is crashing around us. Let’s take a look at the Gold chart since February:

Recall that the FOMC’s preferred measure of inflation is the PCE, not CPI, although the CPI does provide inflation related information. The next release of CPI data will occur on Feb-14 (Happy Valentines Day…). Again, the FOMC prefers PCE data. CPI Chart below, most recent data reflects a CPI of 1.8%. Ideally it retreats to 1.6% or 1.7% on Valentine’s Day release. Note that leading up to the recent Bear Markets (sustained downtrends) in the last 20 years, the Core CPI exceeded 2.25% on a multi-month, consecutive basis. We are not there.

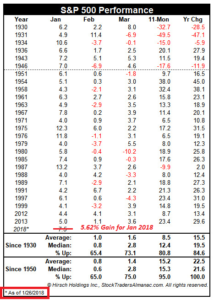

Recently we have had panic and negativity, let me introduce some optimism. Based on my analysis of things, my opinion is a Bear Market (an extended and sustained period of damage) is not immediately ahead. Yes, we touched correction territory. The US business environment has arguably never been healthier, and with reforms and tax cuts (Note: Tax cuts indeed reduce revenue to pay our financial obligations and impact our US Dollar, that is another topic…) will serve to benefit the stock market. Since 1950, seven out of nine Bear Markets occurred in a recession. Recession is a bad thing, think about foreclosed homes, unemployed people, and lost jobs. We are not in a recession.

To quickly touch on recent action, Friday Feb-9 witnessed the markets closing strongly up, with Investor’s Business Daily reporting this as “Rally Attempt Day-1.” This is an important concept, typically after four rally attempts, the market will begin a new uptrend and enter a new bullish phase. Coincidentally, the dates so happen to line up that Day-4 (if it rallies every day) will be Feb-14, the same day that CPI is released (in the AM).

Some inquired about my comment from my prior post, regarding the indexes below their 50-day Moving Average. Indeed, this is not preferred, but this just means that “there is work to do”, time to deep-dig analysis on economic data, stock charts, and other information, before any drastic decisions are made.

As a result of the above, my TSP Allocation remains unchanged. Let’s see how this week plays out, CPI on Feb-14 indeed will be something to watch.

Thanks for reading, talk to you in another week or two.

-Bill Pritchard