Good Afternoon Readers

First, Merry Christmas and Happy New Year. 2017 indeed has been an exciting year, on many fronts, and our TSP is no exception. Let’s take a look at some of my personal TSP moves. You may recall my January 13, 2017 post regarding the January Barometer. I shared my opinion that based on market action in January, that 2017 was setting up to be a strong year. I am pleased to report that this analysis was indeed correct: 2017 witnessed the SP 500 return 20%, and the NASDAQ return 29%.

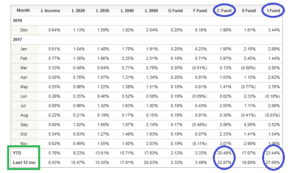

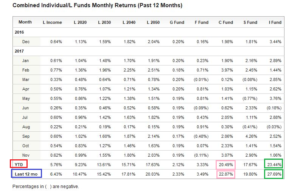

Note that both Year to Date and Last 12-months data reflects that the top two funds were the C-Fund, and I-Fund, in 2017. See graphic:

Further note that I was 100% S-Fund, under the valid belief that small business would benefit most from the variety of economic incentives being advocated by President Trump, however my crystal ball apparently needed calibration as the S-Fund slightly underperformed the C-Fund in 2017. Additionally, the “international scene”, plagued by 2015 and 2016’s terrorism and North Korea fears, caused me to be gun-shy (no pun intended) on international investments. It could be said that my TSP reflected an “America First” allocation. I did shift to 50/50 C-Fund and I-Fund mid-year, believing that was the correct allocation to capture the best performers for the rest of the year. This analysis, like my January Barometer analysis, was correct: those two funds were 2017’s top performers.

Finally, in December, I switched to 50/50 S-Fund and C-Fund, my current allocation. Again, the is performance based, when a new young Quarterback is improving each game and showing promise, I tend to pay attention to him. This is not some sort of witchcraft, tea leaves, mumbo-jumbo, or reading the past to predict the future, etc (all of which some naysayers claim this site does…). It is really quite simple. It is what it is: Being heads-up and alert and responding to the threats/opportunities in front of you. Thinking ahead. Situational Awareness. Retreating to cover and concealment when required. Jeff Cooper. All of the above but applied to our TSP.

Let’s collectively wish for a great 2018. Merry Christmas and Happy New Year. God Bless our nation’s public safety, law enforcement, intelligence, and military professionals so that the rest of America remains safe.

Merry Christmas !!!

-Bill Pritchard