Hello Folks

Thanks for the emails, yes I am still here (and always will be….), however I try not to push out email traffic or site updates unless clearly warranted and when something worthwhile needs reporting. A constant barrage of depressing emails tends to push folks away, so I have held back. I am trying to allow the New Year to bring something positive to report. However, we are now into the second month of the year, and February has not started off very well. The last trading day of January, Jan-29, ended with the Dow positive almost 400 points. The subsequent high-fives and “we are out of the woods” chanter and applause trickled out of various websites and financial television networks, however one wonders if such chanting is like witchcraft, as the markets reversed lower again. January TSP fund data reflects that the S-Fund and I-Fund had the worst Year to Date performance.

My current assessment of things has not changed at all, from my Jan-14 post.

I would like to re-mention that the revolutionary idea (to some) to be in G-Fund to protect your balance is not an idea invented by me, and thus is not something I can trademark, patent, or copyright. That use of the G-Fund is mentioned by both me (on this website) and on TSP’s own official site, so take a look at my Jan-14 post for additional discussion on that. “Stay invested” / “keep buying” / “don’t move your money” / “think long term” [what is long term, age 150 years?] is in my opinion a theory pushed out by some money managers (along with their own fancy math and “explanation”) who want your money to stay under their management. Observe that you will find no such idea anywhere on the official TSP website. Investment decisions (when I move my funds over to G-Fund, that is a decision) can make or break your retirement. The Dallas Police and Fire Pension system (a pension plan run by money managers), is suffering bad decisions, what Dallas PD Chief Brown calls:

“….The pension fund is a very serious problem,” he said Tuesday, referring to what Dallas Mayor Mike Rawlings calls “the billion-dollar hole” in the middle of the Dallas Police and Fire Pension System that pays the city’s retired rescue workers. It’s actually a $1.4-billion-sized hole following years of bad investments and poor management, and the pension fund is in danger of going broke by 2030….”

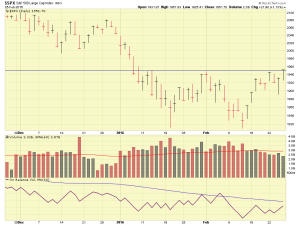

The importance of good decisions is paramount in regards to our retirement, and each TSP participant should look at himself as their own fund manager, and approach their balance with that mindset. With that said, lets look at a chart of the SP 500. Take a look at the horizontal lines I have placed on the chart, our recent overhead resistance and support levels are going to be 1950 (Overhead) and 1870 (Support).

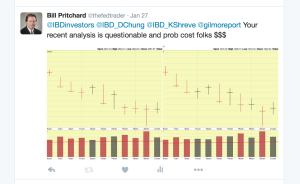

The indexes have witnessed numerous Distribution Days, with the NASDAQ having four (4) days recently. Four to Six days will typically send the markets into a resumed downtrend. Interesting to note is that the folks at Investors Business Daily (I am a paid subscriber) proclaimed that a “Follow-Through Day” (FTD) occurred on Jan-26, long story short, this type of day is symbolic of a potential reversal of a downtrend, and such a declaration could result in some people returning to the stock market and investing their money. As a paid subscriber, and customer, the customer is always right, and I advised them of my discord:

Note that IBD has an excellent reputation overall, but their recent “market calls” have been questionable. I don’t hesitate to share my opinion with them, via various means, when I disagree.

The challenges remain the same, Crude Oil, China, and Interest Rates, or sub-challenges derived out of those categories. It should be noted that the most recent Unemployment Rate data reflects the lowest rate in 8 years, 4.9%. It is my opinion that the FOMC will continue to raise interest rates this year, and not “push pause on additional hikes” as some on Wall Street desire. This would invite (especially in an election year) criticism that the FOMC, a purported independent body, to be in bed with Wall Street: FOMC Chairwoman Yellen is a Presidential nominee, and with the fact that one female candidate from the same party is currently facing allegations of highly paid speeches and her own alleged close ties to Wall Street, long story short, interest rate hikes will continue in 2016. Plus the “data” supports it, great unemployment numbers, along with recent PCE Inflation data reflecting very slight improvement towards the FOMC target of 2%. Again, in my opinion, interest rate hikes will continue in 2016.

Regarding China, fund manager and multi-billionaire George Soros made some comments on Bloomberg, on Jan-7, strikingly similar to mine (however my TSP balance is a little smaller than Soros’ accounts…), made on Nov-15:

Soros / Jan-7-2016:

“China has a major adjustment problem,” Soros said. “I would say it amounts to a crisis. When I look at the financial markets there is a serious challenge which reminds me of the crisis we had in 2008.”

Pritchard / Nov-15-2015:

“One big worry I have is “China”- my opinion is China today, is what USA was in 2007. My opinion is the economic situation in China is very similar to our Sub-Prime mortgage crisis of 2007-2009. In addition to China’s housing situation, their GDP has slowed to 6.9%, which is below the desired 7% rate, the first time it has been below that level since 2009.”

Crude Oil continues to be a challenge, however it is somewhat married to the other challenges. A slowing economy in China will result in lower oil consumption, and interest rate hikes (in theory) could result in reduced spending and a desire to increase efficiencies by major corporations. Don’t let “cheap gas” fool you into thinking that airlines, trucking companies, etc suddenly don’t look at fuel expenses. These sectors will always seek to maximize fuel savings and are constantly seeking new engine technology, and new strategies, in regards to fuel expenses.

So, are we in a recession yet ? No, however my opinion is the market is a leading, not lagging indicator, of economic conditions. As discussed on this site before, go to other sources and listen to other trusted financial experts, all whom believe, like I do, that the stock market is indeed a leading indicator, such as Charles Schwab, New York NYU Stern Business School, Chicago Booth School of Business and the American Institute for Economic Research.

It it is possible that in late 2016, our economy could be declared to be entering a recession. That word, similar to “fire” in the Movie Theater industry, or the word “sink” in the Cruise Ship industry, is a pretty powerful word, folks in political circles and leadership roles in the financial industry will do everything they can to avoid saying that word. Just keep in mind that the markets don’t lie, and they always lead. We may hear that word mentioned in late 2016. With that said, let’s monitor the 1950/1870 levels on the SP 500. I remain 100% G-Fund until further advised.

Thank you and talk to you soon. Please continue to share this site with your friends and coworkers. Thank you !

-Bill Pritchard