Guys, I want to wish everyone a HAPPY NEW YEAR. Lets all be safe and make good decisions as we celebrate the closure of the year and the beginning of the New Year. I would like to post some final market comments before we all go off the grid for the next couple of days.

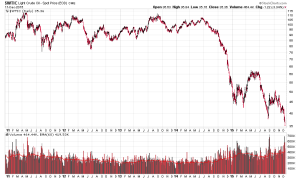

2015 was a challenging and difficult year, for all. You and I, are not alone in our frustrations. It is not just me, a TSP participant and “non Wall Streeter” who had struggles, finally going to G-Fund back in August. Bloomberg Business had a segment regarding 2015’s market struggles, please take a look:

With that said, lets take a quick flash-back to my first post of 2015, dated January 7, 2015. In that post, I commented:

“….The first trading day of January is symbolic as it tends to “set the tone” for things to come. Then on Monday, January 5, arguably the first trading day “operationally speaking”, due to the New Year’s weekend now past, witnessed the Dow Jones closing down 330 points. Then Tuesday, January 6, the Dow Jones closed down 130 points.

While I am the first guy in a crowd to try to look for the positive when surrounded by bad news, I admit there just isn’t anything positive so far this new year from a market standpoint….”

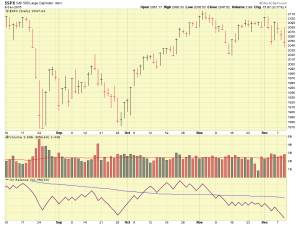

Flash back to today, December 31, 2015, and we have the Dow Jones Index (the same index discussed in my January 7, 2014 post) has had its first annual loss since 2008.

Today the Dow traded lower by 178 points. While volumes during the holidays are indeed light, I would have sure preferred a flat close or a close of just a few points positive versus losing 178 points on the last trading day of the year. The Dow Jones is joined in poor 2015 performance by the SP 500 index, also going negative for the year. In fairness, many Dow Components are also components of the SP 500, but the bigger point is that these indexes represent (in theory) the largest, most financially stable companies that trade on the stock exchanges. The NASDAQ is positive for the year, but note that some of the larger NASDAQ components aka Apple, NetFlix, and Amazon, on their own, had great individual performances, thus giving some updraft to the overall index.

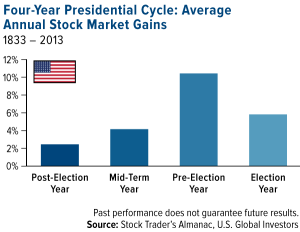

Note that historically the year before a Presidential election year (that means now, 2015) is typically bullish, or up. This year it was not. See Table:

It is obvious that 2015 is not up 10%, not anywhere close, we are negative for the year (aside from some NASDAQ stocks).

It is obvious that 2015 is not up 10%, not anywhere close, we are negative for the year (aside from some NASDAQ stocks).

The positive to all this is that a Presidential Election, no matter what party or candidate, typically will kick a Bull Market off as it is a “catalyst” event. So lets keep our fingers crossed on that. Besides an election, 2016 is expected to see multiple additional interest rate hikes.

At this point, my TSP balance is safely tucked into bed, resting under the warm blanket called the G-Fund. Interesting to note is that the G-Fund was the only positive fund in December, per the home page on GovExec website. The official TSP home page does not show December returns yet, however per GovExec, the worst performing (non-Lifecycle) December funds were the S-Fund and I-Fund. While some may snicker at my admitted conservative approach, positive returns are always better than negative returns. There is no economic theory, business school analysis, or magic investing formula, that will refute that. None.

I remain 100% G-Fund. Happy New Year to all and lets make 2016 another great year for subscriber growth. If my site has caused piqued interest in your own TSP performance, triggered an elevated interest in the stock markets, or caused a heightened monitoring of your finances, that is great. If someone else, a colleague or coworker, would benefit in a similar manner, please share my site with them and encourage them to subscribe. This (free) site is run by a real human (me), a fellow TSP participant with “skin in the game.” Some of the “other sites” have difficult to identify ownership (who is this dude), unknown bigger intentions (are they trying to sell me something?), and other practices.

Thank you for a great year in subscriber growth and see you in 2016.

Happy New Year everyone

-Bill Pritchard