Good Evening Folks

I wanted to send out an update before a lot of my audience goes out on leave / steps away from their computers during Thanksgiving week… Some interesting topics are covered in this update, and I promise that you won’t be bored (or puzzled by over-technical terminology, which I have always sought to avoid).

I have received some great reader emails over the last week or so, thank you for the positive comments. One common question remains “when you change your current TSP allocation, what do you mean by that”. I ask that if you have that question, please take a look at the FAQ #10, as it is discussed there.

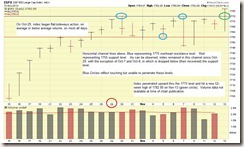

A review of recent trading activity on the SP 500, which is my personal “go-to” index for market health and analysis, shows that the index made yet another All Time High on November 22, 2013, reaching 1804.84. See chart below:

The new highs during recent days have been on lackluster volume, which is the only negative in an otherwise positive situation. As I have explained in prior posts, volume is the “horsepower” behind a price move…we ideally want new highs to be made on average to (more preferred) above average volume. However, I will take new highs, if that’s all I can get. The prior week’s trading reflects that small-cap stocks (S-Fund) outperformed large caps, however a longer look-back reflect that large-caps (C-Fund) are still outperforming on a two to four week view. Simple version, my current TSP Allocation of 50% S-Fund and 50% C-Fund is probably the most ideal allocation right now.

I wanted to post a 2013 article from Federal News Radio, regarding a reader letter (to Federal News Radio), from a member of the TSP Millionaires club. As most of my subscribership knows, I feel that the G-Fund is best for safety and protection, not for gains. I also feel that it is wise to move to G-Fund when the market itself (not somebody’s crystal ball) signals possible trouble ahead. With that diatribe over, allow me to post a link, and cut and paste (in italics) portions of the article. Article is property of Federal News Radio and is not mine.

http://www.federalnewsradio.com/20/3458095/Federal-TSP-millionaire-tells-how-to-join-the-club

“…I am one of the 929 TSP millionaires mentioned in your column. Not born with a silver spoon in my mouth either, for growing up, my family never even had a car. I’m 58 years old and have over $1 million in the TSP, beginning with contributions 25 years ago. Attached is a plot showing how it happened, by putting the maximum amount available (although past 50, due to other financial obligations I did not even add the catch-up available for 50+). I did make sound investments with timing, for I made double-digit growth extraordinaire during the booms, and was fortunate to avoid the busts by moving it temporarily to the G fund. I have some advice that I think you should offer the young bloods out there joining the federal government and that they must contribute their maximum amount to the TSP. That is rule #1.

There you go folks, someone independent of this site with a similar opinion regarding the G-Fund. You know my opinions regarding buy-and-hold, versus the usage of the other funds as tactical protection vehicles. Some other sites have differing views on topics such as Buy and Hold, the use of the G-Fund, and other stuff. Welcome to America, we all can have a voice. But read the TSP Millionaire’s letter, to another very reputable site, and make your own decision on what works and what doesn’t. If folks want to Buy-and-Hope Hold during bear markets such as 2000-2002 or 2007-2009, hey good luck, just don’t take your buddies with you.

As a transition to that, I noticed in the media some Market Bears coming out of the woods. As many know, a “Bear” is someone who believes the market will be going down soon (“soon” never being clearly defined) and that doomsday is around the corner. Allow me to post some links

Goldman Sachs predicts 10% drop in SP 500 This is an interesting article, you have to love the folks who stick their neck outs a little bit, but not too much, as they can claim “being right” if they indeed get their predictions accidently correct, and if they are wrong, well no big deal, they weren’t predicting anything huge anyway. Kind of like that guy at work, who we all know, who silently applied for a promotion, and when prompted by a colleague, his response is “I am not expecting it, I doubt I will be pulled away from (insert name of incredibly important project here) that I am working on” or similar statement. I mean, if he is not promoted, this guy is “right” and can take credit for his accurate prediction. If he is wrong, well, he gets promoted and tells everyone how “shocked” he was. Bro, come on. The better answer is “Yeah Larry, I applied, lets see what shakes out.”

Market may Tank An entertaining article with interesting adjectives to include the word “overstretched” and stones going over cliffs. Yet another mention in the press of “the economic cycle.” Do ANY of these authors understand that the stock market is a LEADING INDICATOR of the economic cycle ? If you WAIT for the economic cycle to become healthy/reflect healthiness, and THEN invest in stocks, you will be buying very likely as the market’s fuel tank is about to hit empty and come to a halt. No wonder (unfortunately) most of the public cannot amp-up their returns, it’s not their fault, it is the fault of the media and the “experts” out there. In the “don’t take my word for it” (TSP Millionaire letter is also in that category) category, lets link over to New York’s Stern Business school.

The current index of leading indicators (it changes from time to time) combines the following series:

Leading Indicators

1. Hours of production workers in manufacturing

5. New claims for unemployment insurance

8. Value of new orders for consumer goods

19. S&P 500 Composite Stock Index

Doomsday Investors – Market may Crash May 24 2013 article claiming market will crash. Posted on CNN Money, with who knows how many millions of viewers. I have no data regarding how many grandmothers cashed out their E-Trade account after reading this article. I hope not many. May 24 2013 SP 500 close was 1650.51. Nov 22 2013 SP 500 close was 1804.76, reflecting a gain of approximately +9.3 %

So there you go folks, while I can’t tell anybody to completely stop reading market news (and yes, I watch CNBC, read WSJ, etc.), I ask that you exercise some skepticism when you listen to purported experts or read things (and yes this includes this site. Put that in the “refreshingly honest” category). Take everything with a grain of salt and at the end of the day, do what makes you feel most comfortable.

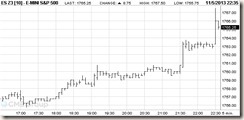

With that said, a quick Nov-24 evening look at the SP 500 futures reflect yet another new high on that index (the futures index). See chart below

As can be seen, the SP 500 futures index hit 1809.25, before pulling back slightly. While my crystal ball is still inop, my opinion is that this is possibly a positive response to the recent Iran/USA nuclear agreement signed over the weekend, which is apparently not a final-final agreement but a “first step” towards a larger agreement. Crude Oil futures went lower as a result, and everybody likes cheaper gasoline for Holiday Travel (whether this will show up at the pump is yet to be seen). However, any stability (perceived or not, perception is reality) in the middle east, especially regarding OPEC members and countries with nuclear capability, is likely a positive for the markets. SP-500 Sunday evening futures typically are a reliable indication of how the Monday daytime trading on the stock exchanges will be.

During this upcoming Thanksgiving week, trading will be very light (markets are closed on Thanksgiving day) and as such, any behavior in the markets this week will not be genuine signals of anything important. Expect light back-and-forth, mostly flat trading.

In closing, my personal TSP Allocation remains 50% S-Fund and 50% C-Fund. I hope you enjoyed this most recent update, and I ask that you please share this site with your friends and co-workers (my free site’s revenue stream [zero] cannot afford advertisements in the Wall Street Journal).

Everybody have a GREAT THANKSGIVING and talk to you soon. Remember, one day of defrost per 5 pounds of frozen turkey. Know that now or deal with a divorce attorney later. Been there, done that…..

– Bill Pritchard