Hello everyone

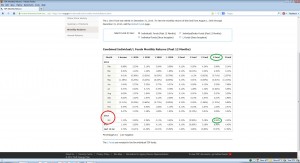

The first month of the year is behind us, and as expected, the S-Fund came out the top performer. On January 2, I discussed how the S-Fund would likely be the place to be, out of ten different fund choices that exist. Subsequently, the S-Fund outperformed all funds, with a 6.96% return. Please see graphic from the official TSP site.

My analysis of January’s activity reflects that I-Fund is “catching up” to the S-Fund, performance-wise, however for the present time, I am remaining 100% S-Fund. This is due to various reasons, the first and foremost is, my analysis of the markets reflect that S-Fund will likely remain strong, and that historically, in February, small cap stocks outperform large cap stocks (international stocks are not part of that historical study).

Some notable events have occurred this past month, such as AAPL stock suffering hits to the downside as investors wonder if AAPL’s growth and ability to obtain new technology breakthroughs have stopped or slowed. In addition, Android growth has seriously impacted AAPL’s earnings. Since AAPL is a major member of the NASDAQ, this has caused that index to go down somewhat. Are the markets “headed lower?” No, this is just one stock affecting things. (AAPL is not a small cap stock by the way).

Some have emailed me and asked why is the market going up, if the economy is still down. I offer this explanation, that historically, the stock markets are a leading indicator of economic events, not lagging. In other words, in six to twelve months, we may see the economy finally getting back on track. I might add that some believe it already is flashing signs of life. At the end of the day, I simply respond to the markets themselves. To further that theory, I am posting a Jon Stewart video, who criticized Jim Cramer. Watch this video and you will understand why people should not blindly listen to “experts” on TV. I have no personal opinion regarding Mr Cramer, but as they say in some circles, “it is what it is.” Video is courtesy of YouTube and MSNBC. You may need Google Chrome for the video play properly.

As of 02-04-13, I remain 100% S-Fund. I am monitoring the other funds and as discussed, the I-Fund is showing some promise. Last month, this site provided some insight into fund choices, ten choices of which TSP investors must wrestle with and attempt to decide on. This site provided accurate information as to the top performing fund(s) and delivered to subscribers the #1 fund at the time. Thank you for reading.

Bill Pritchard