Hello Folks

As Robert Herjavec from CNBC’s Shark Tank program would say…“wow” – That is my reaction to this BREXIT stuff.

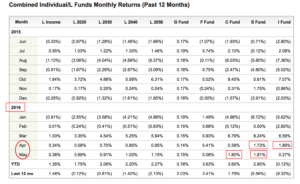

Let me be clear: I, and most of the world, would have preferred a “Stay” vote, and indeed, the recent carnage (drama?) would have been avoided (or could it have been?). Lets do a quick walk-thru of the house that recently caught fire. However by the end of this post, you [hopefully] will feel a little more comfortable that things will be OK. Note that the BREXIT vote falls under the category of Political change/economic policy catalyst, discussed in FAQ #9 on this site (this FAQ has been posted for years and is nothing new or revolutionary.) Also note that for what seems like years, I have shared my concerns on this site with investing in the I-Fund. It seems that volatile crude oil prices, financial scandals in Emerging Market countries, terrorist concerns, and political unrest are not enough reasons to keep some folks (this is not a criticism, but…) from the tempting potential returns in the I-Fund, but maybe the BREXIT scenario will serve as a wake-up call. I am disappointed at the financial media and “experts” who push diversification and exposure to Europe as being helpful for your portfolio. In fact, recent studies have revealed that diversification does not necessarily work in a stock portfolio, and may not be effective even if using multiple funds/ETFs as a diversification method.

The way I see it, you are either “with them” or “with us”, and not a flip-flopper or wishy-washy. Stocks ? Or Not ? That is just me, but it is important to understand my view on the topic of stocks.

As most of us who own a TV or have some sort of internet dial-up or faster connection, we know that the BREXIT vote was official on Friday June 24. It appears the “Leave/Yes” vote was chosen by the demographic of the blue-collar worker, lower class income (versus upper), and with no college education. The sub-argument that blue-collar workers indeed would have an income lower than the wealthy is another topic for another day. The observation made (by me) is that the Pro-BREXIT camp possibly did not understand what potential negative consequences, nor had any broader concept in mind, what their vote would do for the UK. Note also that the UK is technically four countries, England, Scotland, Wales, and Northern Ireland, with the capital being London (the largest financial center outside of NYC), and the Prime Minster (since resigned) being a guy who was born in London. As such, Britain was awarded the first two letters in BREXIT, and carries the most horsepower of all the UK members, for a variety of reasons.

Further note that the “Stay/No” vote demographic was determined to be the wealthy, upper class, college educated, and white-collar workers. Warren Buffett, Richard Branson (Virgin Atlantic fame), Prime Minister Cameron, and others, all expressed concern (rightfully so, as we saw…) about a vote to leave. However the leave camp won the vote. This led to a huge sell off, at least initially, on Friday, and again on Monday. The fact that the weekend was sandwiched between both sell off days should not go unnoticed as it carries large psychological importance in this situation. Friday was a big sell off because folks panicked and unloaded positions, wishing to be “out” over the weekend, a period when the markets are closed, and then on Monday, whoever could not get out on Friday, having spent the entire weekend sulking and scared to death, dumped their positions as soon as possible on Monday, fearing calamity and disaster just around the corner.

Soon after markets recovered, and in my opinion, will continue to recover. Here is why:

-This wrench tossed into the global market place will almost certainly quash any US interest rate hike this year.

-Money previously invested in European markets may be re-directed to reliable and safe USA, which for all of its issues, remains one of the safest places for equities/stock market investment. This may gain additional momentum once the current President is changed out.

-BREXIT itself has not happened yet. This factoid has been missed by many. The vote indeed happened, but the physical divorce has not happened yet. This requires an “Article 50” action, which is a formal legal process to begin the divorce, an event which is allowed to take up to two years. The most recent Prime Minister has refused to begin the Article 50 process, and instead said he will leave it for the next Prime Minister, who report on Sept 2, 2016. Also, nobody has a clear yes/no answer on whether a new election can be pursued regarding BREXIT, and this could be an option.

-Gold, a safe haven currency, came off recent BREXIT panic highs, simultaneously as the US markets recovered up. This is classic safe-haven money flow behavior, and reflects that the recent upticks in US markets are not merely a mirage in the desert. See Gold Chart:

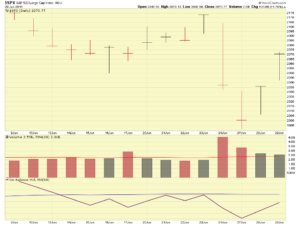

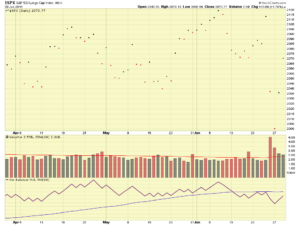

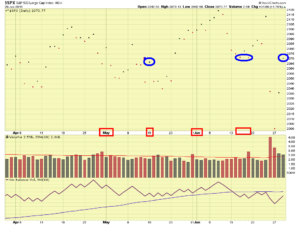

-For all the damage done on Friday and on Monday, the indexes are closing near mid-June (pre-BREXIT) levels. “Close Price” meaning the price they traded at when the exchange closed or stopped trading, for the day. These are depicted as “Dots” on a chart, known as a “Dot Chart”, see below:

-Recent uptick action on Tuesday and Wednesday was on above average volume. I don’t think we will see upticks on any volume greater than the sell-off volume on Friday (which was a panic sell off), as re-entry to markets is usually done cautiously and slowly. But above average volume merely days after the vote is a positive sign.

The major damage done was that done to the Dow Jones Index, and this happened because JPM (JP Morgan), AXP (American Express), and BA (Boeing) are all companies with large financial exposure to European markets. Those stocks got creamed Friday, thus taking the Dow Jones down with them.

In my opinion, the market response to BREXIT was an overreaction, and we will see a return to normalcy in the coming weeks. Did I say this was my opinion ?

That is all I have for now….I remain 50% S-Fund and 50% C-Fund in my TSP.

If you enjoyed this post, and prior posts, please share my site and emails with others who may benefit. My recent polling information (some advised they could not use the embedded links due to restrictions on their work computers) indicate that 72% of my followers use this site as their only or as their primary TSP and market analysis site. 92% stated that this site has expanded their knowledge of the TSP and the stock market. My huge subscriber growth is not by accident or magic, and I thank you guys for being part of this success. Please continue to share my site with your colleagues and friends. Thank you !

-Bill Pritchard