Part-2 of Interest Rates, mostly prompted by some very good email questions yesterday, to include “where are you getting your data”

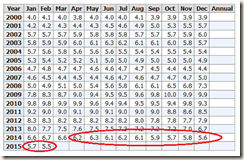

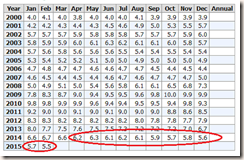

For official Bureau of Labor Statistics unemployment data, go to this link below,

http://data.bls.gov/cgi-bin/surveymost?bls

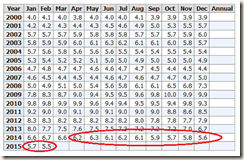

then choose Unemployment Rate (Seasonally Adjusted), fourth choice down under Employment category, then choose Retrieve Data. That will then bring up the below chart, sans red circle:

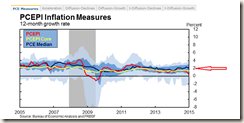

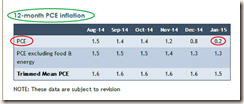

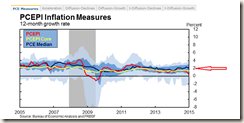

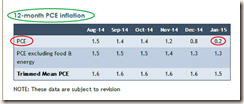

Regarding the Price Consumption Expenditures Index (PCE), which Federal Reserve officials have gone on record as being the primary inflation measure (Google “inflation” and you will get numerous and different results), use this link below. This is 12-month data- PCEPI Core (yellow line) is data without considering food and energy, PCEPI (red line) is “straight” PCE with nothing removed. No matter how you look at it, we are not at the FOMC-desired 2% rate yet.

http://www.frbsf.org/economic-research/pce-personal-consumption-expenditure-price-index-pcepi/

You can also go here, but you need to look closer to find the PCE:

http://www.dallasfed.org/research/pce/

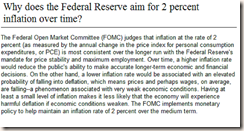

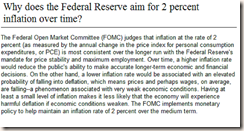

You have to love the government, you need to hit five sites to get the data you want. As to “Why the 2% rate?”, lets go to the FOMC themselves and ask that question:

http://www.federalreserve.gov/faqs/economy_14400.htm

An additional question is “What is inflation”, again, best we go to the FOMC and ask that, since they are the ones calling the shots (many definitions exist via Google).

http://www.federalreserve.gov/faqs/economy_14419.htm

Note the frequent referral to PCE index, this is the primary benchmark the FOMC is using.

Observations, as discussed yesterday are: 1) Yes, unemployment is improving if we use the data provided, below the 6.5% level which is the oft-mentioned level the FOMC is looking at, prior to interest rate hikes. 2) No, PCE inflation data does NOT reflect 2%. Remember the FOMC wants 2%, t-w-o, not 1.5, not 2.5, but 2%. We are simply not there yet. PCE Core, which is not counting energy, is almost (but not) there, and PCE is clearly not there. If PCE was 1.8, 1.7, 2.0, 1.9, over multiple reporting periods, OK, I may accept that. But PCE is nowhere near even those levels. PCE is in fact deteriorating, each reporting period. It is not stable, nor improving.

In my opinion, we now may not see interest rate hikes in Summer/Fall, which is presently believed. Not if the FOMC wants to abide by statements and language they release to the public. As many federal government employees understand, releasing an agency policy statement then not abiding by it is a pretty big deal.

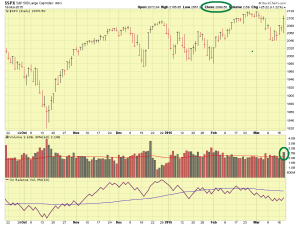

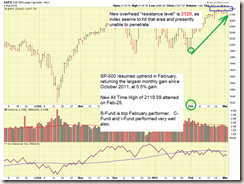

I remain 100% S-Fund. FOMC Meeting is March 17-18, we should hear some news by COB March 18 or sometime on March 19. As discussed yesterday, if we learn that at that meeting, the FOMC is concerned about non-movement towards the 2% PCE levels, and implies a delay of the rate hike, the markets in almost all certainly will embrace that strongly. The “Inflation” topic is front and center now, because the unemployment numbers, basically for one year, are where they need to be. So the spotlight has moved over to Inflation. Jobs data is first, as unemployed Americans and hungry families is a pretty big deal, but the jobs/unemployment data is now reflecting pretty good numbers and the spotlight is now on the PCE. I would be shocked if PCE/inflation was not a topic at the next FOMC meeting.

“The strong dollar may hurt our economy” is sometimes discussed in the media, with the reasoning that Multi-National Enterprises (MNE) such as Wal-Mart, with stores overseas, may see overseas sales negatively impacted, since the foreign currency in that county now buys less that what it did last year. These companies may report lower profits, and thus send their stock prices down. While probably correct, I am not loosing sleep over a strong dollar. Most corporate, Fortune 500 companies, are selling products domestically. Ford does not sell F-150 pickup trucks to Germans in Frankfurt. They sell them here, in America. NOTE: Boeing Airplane Company, etc may be an exception to this. A strong American economy means folks are buying cars. Strong economies typically result in strong currencies, and vice versa. I am quite proud that our dollar is (thankfully) strong again. Not a surprise was that its historical all-time-low was in mid-2008, in the middle of our mortgage and financial crisis in USA. The strong dollar, cheap fuel, and other topics are best left to much smarter folks such as the FOMC to figure out. In short, I am not getting wrapped around the axle over our “strong dollar.” I like my dollar to be worth something. Strong is typically good.

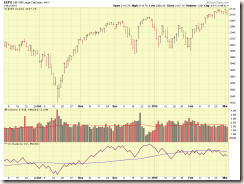

I may post additional updates prior to March 19, but to be quite honest, I expect some increased volatility and turbulence until that date, but with really no earth shattering news. If the Dow drops 500 points or something, I will share my analysis, however I don’t foresee anything but rough seas between now and March 19.

Thanks for reading and talk to you soon

– Bill Pritchard