Hello Everybody

Today is Sept 30; the markets have continued to decline since my last update on Sept 25. It is worthwhile to mention that since August 7, I have expressed my personal opinion regarding concerns that the market is weakening and becoming a risky place to be in. Since August 7, I have been 100% G-Fund. I got a few reader emails regarding being over-conservative and some “missed gains” but I stand by my opinion that the markets are deteriorating. I have wished and hoped for positive signs, and believe me, watch the market everyday, searching for a slice of good news or rays of sunshine between the storm clouds, but have not seen any yet.

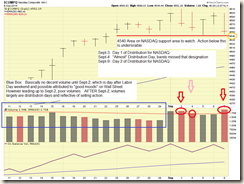

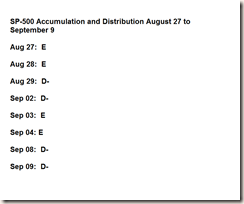

Today we had another Distribution Day in the markets, and according to the folks over at Investors Business Daily, we are at 7 Distribution Days for the NASDAQ and 6 days for the SP 500. I include “almost distribution days” in my personal assessment of the markets, as “almost days” are important to be cognizant of, even if not technically qualifying as Distribution days. We have had a handful of “almost days” in both indexes. As discussed on this site, multiple days of distribution, typically four to seven, within four to six trading weeks, tends to stop existing uptrends and reverse them into downtrends. We are basically at that point now.

Lets look at some charts. I used SPY ETF for a better snapshot of volume activity of the SP 500. Note that 1965 is the new support level for the SP 500. Any penetration below this level is yet another warning sign of an upcoming (and now probable) Bear market.

As we can see, the index continues downward, with increased volume during the recent few days. It should be noted that a frequently used Small-Cap Index, the Russell 2000 (the TSP S-Fund will behave very close to this index), is already below its 200-day Moving Average, which is a Bearish (negative) sign for small-cap stocks.

It is valuable to consider the fact that prior bear markets caught most people by surprise, this occurred in 1987, in 2000, again in 2008 (although less so, most woke up to the fact that a grave crisis was in the works), and will probably occur again this time around. History almost always repeats itself. In almost every case, investors were riding the euphoria of a prior bull market and “good times”, and with their heads in the sand, got blindsided by a bear market. However warning signs exist, all documented on this site, of a possible looming bear market. This can occur gradually “death by a thousand paper cuts” or can start with a huge slam down, then a continued, but gradual, downward trend. While one cannot predict the severity of the next bear market, one can control his exposure via allocation decisions and diversification, to include being entirely out of stocks all together.

Now, the market may magically reverse direction tomorrow and go to the moon. And if anybody wants to be out of G-Fund, it is me. But, I don’t see that happening.

In summary I continue to remain 100% G-Fund.

I ask that everyone continue to share this site with friends and colleagues. Subscriber numbers have gone into the stratosphere, and I want to keep the momentum going.

Thanks and talk to everyone soon

– Bill Pritchard