Hello Folks

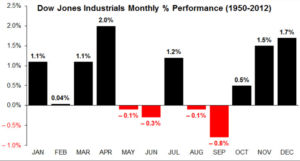

The last trading week of May is now behind us- allow me to discuss my TSP allocation & contribution changes, and my analysis of recent market action. As we enter June, one must ask where did the year go, time sure flies when you are having fun. June also happens to be part of the historical “summer doldrums”period of flat market action, which lasts from May through September:

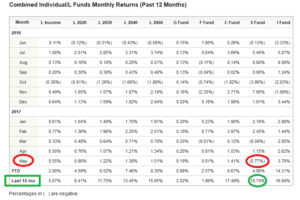

Additionally, June represents “Month #6” of President Trump’s new administration. Our new President is indeed setting new tones and taking actions not seen before. As such, the market has not acted completely in line with prior historical “first six months” periods of past Presidents. Using prior data and behavior is great; I rely heavily on trends and “historical behavior” to temper my decision-making, however some of this has proven have lesser accuracy, likely due to the fact that President Trump and his advisors indeed are charting new courses and taking actions not witnessed before. The S-Fund lagged in May, returning a negative performance, a rare event in an otherwise up market. Such a laggard performance is a red flag for that category (small caps), it appears institutional money is indeed flowing to large caps (in this category exists Exxon, Caterpillar, Boeing) and flowing to international stocks (I-Fund). See graphic, from the official TSP website:

S-Fund still performed best on a 12-month period, however the last few months have impacted its YTD performance. In finance and investing, it is said “don’t fall in love with your position” and my ties to the S-Fund are about to be severed. My personal TSP Allocations and future contributions will be changing to 50% C-Fund, and 50% I-Fund.

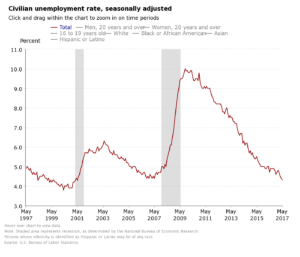

Economic and political news over recent weeks has been largely positive, at least as far as I can tell, having stopped watching the two extreme leaning (both in different directions) news sources and instead obtaining my news from BBC, Bloomberg TV, and the Wall Street Journal. While no media source will be completely unbiased, I encourage a look at the aforementioned sources if you are tired of the circus on the other channels. The markets seem to have embraced President Trump’s first international trip, and the recent “Jobs Report” reflects the lowest unemployment level in 16 years, 4.3% in May. A chart reflecting the unemployment rate is below:

The next major news event which may impact the markets will be the Federal Open Market Committee (FOMC) meeting, on June 13-14. Indeed, the improving economy will give reason to discuss an interest rate hike. However, as mentioned before, the market is policy and politics driven, and it is no longer about rate hikes. However this topic will likely be discussed at the upcoming FOMC meeting.

Lets move forward with some “market talk” and discuss my favorite thing, charts and technical analysis.

On 06-02-17, the SP 500 closed at a new All Time High, attaining 2440.23, having broken the 2400 overhead resistance level on 05-23-17.

All Time Highs are indeed a positive thing. The international stocks are also doing this, the ones we are concerned with occupy the MSCI EAFE (

As can be seen, a huge “gap up” occurred on 04-24-17, with strong volume and accumulation occurring since. Gap Ups are further explained in my prior 2014 post here: http://www.thefedtrader.com/01-15-14-update-sp-500-gaps-up/

I have received some inquiries as to “What changes are looming for my federal retirement.” I am unable to answer them, all require fluency in federal benefits, accounting, and other such specialties, especially since a myriad of possibilities exist as to each employee’s personal situation. I will however, provide you with additional information sources, as I too, am concerned about this topic. The person who is an expert, is Dan Jamison, of the FERS Guide, I strongly recommend that you become a subscriber to his newsletter.

Below is a video from Federal Times, in which Jessica Klement from NARFE is interviewed on this very topic.

It is important to point out that none of the proposed retirement changes have taken effect yet. I do expect some fireworks as we get closer to September 30, my crystal ball anticipates another government shutdown ahead.

That wraps up this update, hopefully I have shed some light on recent market action and articulated my reasons for my new TSP Allocation of 50% C-Fund, 50% I-Fund. My subscriber-count continues to grow at a rapid pace, exceeding the population counts of some small cities. All agencies are represented, civilian and military alike, to include financial advisors in private practice. “Thank you” for sharing this with your friends and colleagues.

See you in a few weeks……

-Bill Pritchard