Hello Everybody

If one thing is for certain, it is that when the markets get frustrating, my reader feedback, website page views, and new subscriber sign-ups sharply increase. Thank you for your feedback, I truly appreciate it. With that said, yes the markets have rallied but only just now are they back to the point they were at in August. The recent uptrend has been on rather lethargic volume, in light of the high volume sell-off back in August. My default benchmark, the SP 500, has apparently encountered overhead resistance (again) in the 2100 area, it seems that every time it penetrates thru that level, imaginary hands reach out and pull it back down.

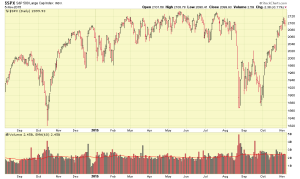

Lets take a look at some charts:

The SP 500’s recent highs have been 2114 on July 31, and 2116 on November 3. Prior to that, it had activity at or near the 2130 area, since May. I know I spoke of prior (and different) overhead support levels in prior posts, but the market is not a static, stationary animal, so as its behavior changes, it is useful to apply different benchmarks, albeit not grossly different. With that said, I am eager to see the index penetrate the 2120 level before I move any of my funds back to stocks.

Numerous things continue to challenge the markets, some of which are:

- Growing frustration with no interest rate hikes from the “just get it over with” crowd on Wall Street. Rates indeed may rise in December. This is the #1 challenge right now.

- Difficult to verify economic reports from China, a Communist country, reflecting a slowing Chinese economy. Some believe that if the data could be fully vetted, the data would be much worse.

- A slowing world economy, downplayed by European cheerleaders who seek investment in their own (slowing) economies.

- Select, specific, sectors/industries that are booming, causing markets to go up, not necessarily reflective of the bigger picture. Severe Dow Jones index swings are triggered by this.

So while some may point out that I “missed” some gains from last month until present, a period of 45 days, these same folks are the ones who advocate “in it for the long haul”, “look at long-term time horizons”, etc mantra. So what is it, long-term or not long-term ? Get tripped up over my investment during the last 45 days but claim that they themselves are long-term investors ? In my line of work, those are called contradictory statements.

Observe it is hard to quantify the safety the G-Fund gives us, akin to the seat-belt when a traffic accident is looming ahead or opening the umbrella as you walk to the car, with thunder heard outside. How do we put a number, how do we measure, the usefulness of the seat-belt, if indeed you never wrecked your car, how to we obtain a value, of the umbrella, if it didn’t rain after all ? This indeed is difficult, as we are trying to measure protection for things that never needed protecting (in the end). This is all outside of the scope of this website, however we all pay insurance on our homes, every year. Did you stop paying this year because you “just never had a fire yet” ? Of course not.

With that said, I am 100% G-Fund, in my TSP account.

Observe that I am eligible to retire in less than 5 years, so I may indeed be too conservative for some readers. If anybody wants to be out of G-Fund, it is me. If anybody could use some gains in their account, it is me. But if you have watched the market long enough, you learn to trust your gut instincts. If you have 40 more years of government service, G-Fund may not be the place right now. But, me – still 100% G-Fund. I will continue to monitor things and post updates here accordingly. Thank you for being a reader and please continue to pass the word to friends and coworkers, as you obviously have already been doing.

If I stay in G-Fund any longer, I may soon change my website name from The Fed Trader to The Scared Trader…(Fed Chicken was recommended by a coworker, I may go with that…)

Thank You again

– Bill Pritchard