Hello Folks

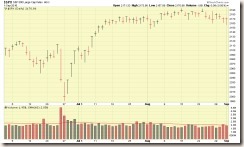

As expected (predicted?) the markets have remained in a mostly side-ways trend, or lack there of, since July. I spoke earlier regarding the fact that August and September are historically weak months- the markets are living up to that reputation. Lets take a look at the SP 500 index, as can be seen, the index is basically flat, bound by 2194 as overhead resistance, and 2147 as a support level. Any break/penetration of those areas would give reason to believe the subsequent action will continue in that direction.

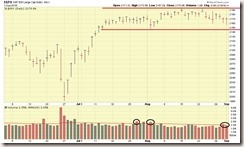

Observe that volume has been fairly quiet since mid-July, however we indeed have had some minor selling on above average volume, as indicated by the black circles above. Chalk this up to “summer doldrums” as I see no signs of heavy, institutional selling which we did see back in the BREXIT Panic of June. Note that even in light of that, me personally, back in June I saw no reason to bail out of stock funds and was confident that things would return to the upside (which they did).

Now that we have talked about the recent action in the markets, lets move forward to what is in store for the near future. On Sept-2, at 8:30 AM Eastern Time, the most recent “Jobs Report” will be released, many in the financial world believe this will set the stage up for a possible interest rate hike at the September 20-21 FOMC meeting, or possibly at the December 13-14 meeting. Most economists are forecasting that 180,000 jobs will have been added. With that said, the consensus is that unless the jobs report is “out of the park”, meaning 225,000+ jobs added (reflected a 25% improvement on the expectation of 180,000), then there will be no fodder for a rate hike. Observe that we are still in the “bad news = good news” market climate. If we get “bad news” such as 175,000 jobs added, below the expectation, the markets will rally, due to no rate hike, if we get “good news” such as 250,000 added, the markets will likely tank, due to a looming rate hike. Ideally we get a jobs report of 175-185,000 and an unemployment rate no less than 4.9%. I say 4.9% because that was what last month’s rate was. Any rate less than that, aka 4.7%, would reflect an improving economy and give the FOMC additional horsepower to raise rates. A rate higher, aka 5.1%, would reflect a worsening economy, which is not a good sign either, long-term.

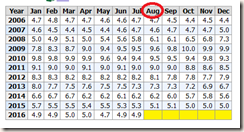

Further note that (discussed on this site previously) the FOMC is mostly using two criteria to determine rate hikes:

1. Jobs/Unemployment Rates – Mostly flat in 2016, minimal improvement. Graphic:

2. 12-Month Core PCE Inflation target of 2% – No improvement. Graphic:

So in my opinion, we will see no rate hike at the September 20-21 FOMC meeting, especially if you include the fact that we are voting for a new President in November, and it is unlikely the FOMC will receive any green-light, tacit, implied, or otherwise conveyed, to raise rates, until the new President is in-place. Indeed we could see a minor rate hike in December, due to this very reason. Did I say this was all my opinion ?

In other news, the FEGLI Life Insurance Open Season has officially begun, Sept-1 to Sept 30, information at this link: https://www.opm.gov/healthcare-insurance/life-insurance/open-season/

Just as an FYI, but if you fall into the below categories, double check that your non-FEGLI life insurance will cover you (aka pay money if you get killed), as many will not. This is a common statement many have told me, they don’t have FEGLI because they have “cheaper insurance” via another company, which may not pay if your death is:

- Ops in War or Combat Zones, etc.

- Flights on non-commercial/non-airline flights or on any non-FAA registered aircraft

- Outside of USA

- Death for any reason, to include suicide. In other words, insurer cuts a check “no questions asked”

As a reminder, consult with your own HR department, financial advisor, etc. in regards to life insurance planning, but this question comes up quite frequently and I wanted to put it out for general awareness. You may be shocked at the situations non-FEGLI insurance will not pay.

That is all I have for now, I apologize for the length of time between updates, but as the above charts show, nothing of mention is happening in the markets. Once we get past September, hopefully things resume to the upside.

I remain 50% S-Fund and 50% C-Fund.

Thanks for reading and talk to you soon !

-Bill Pritchard