Hello everyone

As the world grieves the cowardly terror attacks in Paris, and prays for the victims and their families, let’s take a look at the recent market action.

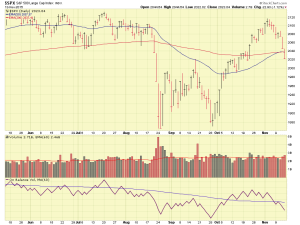

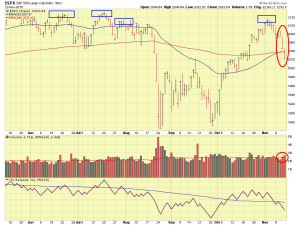

I am disappointed to report that the recent uptrend, which started in, and lasted, all of October, has apparently started to break down. I previously discussed the 2120 area on the SP 500 Index, and this proved to be a pretty accurate resistance area, as the index failed to break through that level and deteriorated shortly afterwards. I was contemplating a possible exit out of G-Fund, if 2120 was breached, but that thought has now subsided in light of recent action. Let’s take a look at some charts:

As can be seen above, the October uptrend began to break down during the first few trading days of November. The distribution day count on the SP 500 is now six days, using Investors Business Daily reporting. Prior historical data reflects that five or more distribution days within a few weeks time, will typically set the stage up for a new downtrend. These days are occurring on higher volume, which is a negative sign, likely due to concerns of a December interest rate hike and the ongoing weak corporate earnings reports. The Friday Nov-13 Paris terror attacks, which occurred Friday afternoon, are not to be considered in our analysis of last week’s action.

Please see additional charts:

In addition, me, personally, I have other concerns about the market. One big worry I have is “China”- my opinion is China today, is what USA was in 2007. My opinion is the economic situation in China is very similar to our Sub-Prime mortgage crisis of 2007-2009. In addition to China’s housing situation, their GDP has slowed to 6.9%, which is below the desired 7% rate, the first time it has been below that level since 2009. See graphic:

Chinese authorities have cut Chinese interest rates numerous times, and this has had little, if any, positive impact on their economy. So we have numerous data sources which reflect that China is slowing down. With that said, like the SARS Virus, a flu in the Chinese markets can (and will) infect the rest of the world.

Chinese authorities have cut Chinese interest rates numerous times, and this has had little, if any, positive impact on their economy. So we have numerous data sources which reflect that China is slowing down. With that said, like the SARS Virus, a flu in the Chinese markets can (and will) infect the rest of the world.

I hesitate to rely on crystal balls or get too heavy into economic analysis, as “price knows all” and at the end of the day, the market is always right. My preliminary analysis shows that the markets will likely continue to lag, and using a 30-day and 90-day look-back, I-fund is the worst performer, with S-Fund the next worst performer, for those time periods, according to my analysis. C-Fund is also performing poorly. The SP 500 index is negative for the year.

To that end, I remain 100% G-Fund. Thank you for reading and talk to you soon.

-Bill Pritchard