Hello Folks

Bottom Line Up Front: My personal TSP Allocation/Contributions: 50%/50% C-Fund and I-Fund.

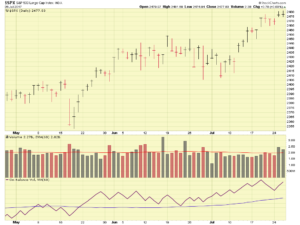

I apologize for the “quiet period” with recent website inactivity, however I prefer not to report on things that do not bear reporting. Indeed we are in the middle of the summer, a period of lethargic performance in the markets; there is just not much going on. On July 7, the markets began to come to life again, with things really looking very nice last week and this week, July 25 and July 26 to be exact. Lets get started with some charts:

Many of the readers have adapted my chart reading techniques- they will recognize that the volume action in the SP 500 Index on July 25 and July 26 was indeed above average, with All Time Highs (ATH) attained both days. This is a very positive sign, and if history is our guide, such behavior will be a harbinger of things ahead: continued up-trending action into August. This is important: August is historically the worst month for the SP 500 and NASDAQ stocks. A positive August will serve as an indicator that the remainder of 2017 will be very strong.

On July 26 the Federal Open Market Committee (FOMC) concluded its July meeting with no change to interest rates. Note that the markets remain earnings and policy driven (attention on interest rates has weakened) however the markets appeared to embrace the lack of a rate hike and embrace the FOMC’s positive language in regards to the economy. PDF Statement

Another event on July 26, was the failed “full” Obamacare Repeal Amendment. Healthcare reform remains a top priority by elected officials, and soon talk of a “skinny repeal” was introduced, which was met by numerous Democrats stating that there was “no chance” a skinny repeal would become reality. While this is not a political commentary blog, I feel this is important as indecision and disagreement by our politicians can impact our TSP. I sincerely believe if everyone can get on the same page, the market rally will get even stronger, which will benefit the TSP.

Speaking of agreements (which also means compromises…), a potential government shutdown looms ahead if agreement can not be reached on the “Border Wall” funding situation. This, too, can impact our TSP, as world stock markets may not be receptive to the idea of a shut down superpower government. President Trump, along with members of the Freedom Caucus, are in support of a shutdown if the politicians cannot otherwise reach an agreement.

As stated above, my personal TSP Allocation is 50% C-Fund and 50% I-Fund. ALL stock funds (C, I, S) are doing very well. I believe we will see the I-Fund end up as the summer’s overall best performer, but again, all stock funds are doing well.

In regards to some questions concerning possible changes to our FERS retirement system, I have located a document from the NARFE, which discusses this topic: NARFE Federal Benefits PDF

That is all I have for now, hope everyone is doing well…talk to you soon.

-Bill Pritchard