Hello Folks

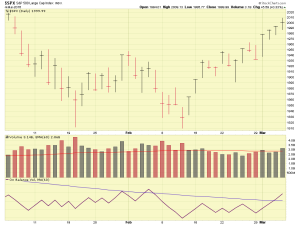

I am happy to report that the markets did pretty darn well last week, with the SP 500 breaking the important 1950 level. However, volume could have been stronger, but was not weak, per-se. I however would prefer some additional volume above its average volume, just as a confirmation sign that “the move” (the price movement of the index) is indeed real. Lets look at some charts:

March 4 volume indeed was above average, but very slightly.

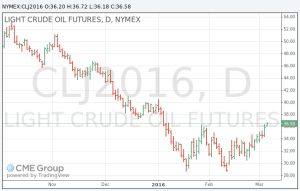

Unfortunately, the markets remain married to the price of Crude Oil, which is now trading at $36 per barrel, depicted on the chart below:

I say “unfortunately” because right now, whatever Crude does, the stock market will do, which means our TSP stock funds and the US stock market is unfortunately at the mercy of oil ministers in the middle east, and will respond to whatever public comments those oil ministers decide to make for radio and TV broadcast. In US-based news, on Friday March-4, the “Jobs Report” was released by the Department of Labor, reflecting a 4.9% unemployment rate in February. This rate is very good, which could prompt a return to “Good News is Bad News” thinking, as a strengthening economy, reflected by numerous indicators (the Jobs Report is one), may signal to the FOMC that interest rate hikes should continue on schedule. Rate hikes tend to dampen stock markets. However, by all appearances, the markets “liked” the Jobs Report and rallied higher.

Some important events will happen this month, on March 10 the European Central Bank (ECB) will have a meeting to discuss their fiscal stimulus efforts in the region. Any plans for additional stimulus will likely be positive for the markets, at least in the short term. Additionally, there is an FOMC Meeting on March 15-16, no doubt that rate hikes will be at least discussed, whether rates are actioned-on is another story.

In summary, we have 1950 penetrated, but I would like the volume to improve. No, I am not going to wait ten more years for the volume. I remain 100% G-Fund, however to put this into language we all understand, last week’s action has caused me to come out of the holster, and into a ready position, with my finger resting near the S/C Fund trigger guard.

Thank you for reading and talk to you soon…

-Bill Pritchard