Hello Everybody

Well, here we are again, where I find myself unfortunately reporting that the markets remain volatile, and largely Federal Open Market Committee (FOMC) driven. You can look at the mainstream financial media for their own assessment of the FOMC Minutes, or you can read mine, the important parts highlighted in yellow, with my commentary in red, at this link: fomc-minutes-9-21-16

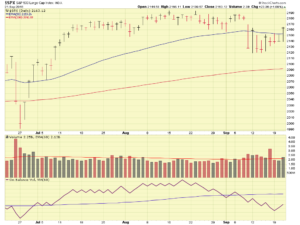

The SP-500 Index remains bound by the 2120 support level and a recently developed 2170 overhead resistance level. Please see charts:

You can look at the above charts and identify the sideways action from July 18 until present coincides with my lack of major reporting activity on this website. It is almost as if Wall Street thinks it’s still summer. We have been sideways since July, with some red flags along the way.

Any penetration of the 2120/2170 levels is cause to believe the move will continue in that direction, obviously the move downward, thru 2120, is more worrisome than any move upward, which I would be happy to see. Indeed the market has had numerous “distribution days” in recent weeks, and remains problematic. Markets sold off drastically on 10-11-16, on above average volume, a troubling sign. On 10-12-16, the markets recovered somewhat, however on lower volume, possibly influenced by the Jewish Yom Kippur holiday, in which some market participants were not trading, resulting in lower volume.

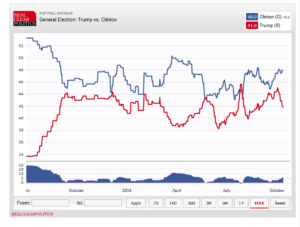

In addition to the FOMC minutes (further analysis at above link), we have arguably the most watched (indeed the most Tweeted…) Presidential Election in history, and different schools of thought exist as to what candidate will benefit the market. What is known, is that the markets do not like uncertainty, so once we are past elections, we hopefully will see some upward progress, when “new blood” is in the White House. The below chart reflects some Polling Data (if you choose to believe it is credible)

There is no doubt in my mind that two hot items remain the catalyst behind the market volatility: 1) Interest Rates and 2) Elections- no larger, headline issues exist from an economic standpoint, at least none that I can see. With that said, at the end of the day, we must respond to the market itself, not our crystal ball or our gut feelings, etc. For now, the market itself is having challenges making upward progress, and any penetration below 2120 will be concerning.

Until then, I remain 50% S-Fund and 50% C-Fund.

Thank you for reading and talk to you soon !

-Bill Pritchard