Hello Folks

On Saturday December 2, at approximately 2AM, the Senate passed their version of the proposed tax bill, which has some slight differences from the House version. However for the first time in a long time, we are seeing progress forward, and the US market futures have responded enthusiastically. Please see chart below of E-Mini Dow Jones Futures, which begins trading on Sunday afternoons:

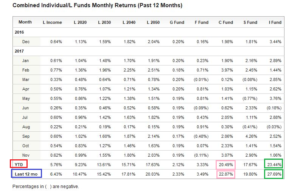

The Dow Jones futures are “trading up” 200 points as of 7:30 PM Central Time, a very positive sign. Unless sentiment shifts, this should result in a very positive Monday in the US stock markets, which will benefit the S-Fund and C-Fund. As such, and after an over-abundance of caution and “wait and see” over the prior months, I will be moving my personal TSP allocation to 50% C-Fund and 50% S-Fund. This reflects a change from my prior allocation of C-Fund and I-Fund, which was fine: both Last 12-Months data and YTD data reflect those were the two top performing funds:

The fact that my prior personal TSP allocation had been in the top two performing funds, out of ten total fund choices, was not by happenstance, it was the result of careful analysis and monitoring of the markets. I have said before, and I will repeat again, that one day panics are not reason to dive into G-Fund or run for cover. I am looking at the overall trend, the structural integrity of the trend, and what stocks within that trend are performing best. I am also watching for “tomorrow’s winners”- redwood trees don’t sprout overnight, they develop over time. It is that same analysis that prompts me to change my personal TSP allocation to reflect C-Fund and S-Fund. S-Fund has been outperforming I-Fund for the last 90 days, for a variety of reasons, and if the final tax bill can clear House and Senate, and get signed by President Trump, all business, large and small, are expected to benefit. Anyone in a compliance-heavy (and who isn’t these days…) industry, in which more time is spent dotting “i’s” and crossing “t’s” and “getting ready for the next audit” versus spending it on the organization’s core mission of selling widgets, or creating solutions for customers, is expected to benefit from the tax bill and future deregulation initiatives from President Trump.

Let’s take a look at the Gold chart to see if any prior selloffs have resulted in a move into Gold, the standard safe-haven currency:

As can be seen, Gold has been relatively “flat” since October, even in light of recent North Korea flare-ups and recent headlines from Washington. This reinforces my belief that prior selloffs were indeed panic driven versus representative of structural cracks in the foundation of the uptrend.

Note that the Christmas break for Congress is December 15, 2017 to January 2, 2018. With that said, Congress has two major to-do items, the Tax Bill, and passing a short-term Continuing Resolution (CR) as the current CR expires on December 8. While the tax bill progress is positive news, nothing is done until it is done, and this week will be a busy one for Congress. Note: Not to be Debbie Downer but any Tax Bill failure (not a delay, but a hard-down, failure) will be a serious problem for the markets. Ideally the new tax bill is signed before 2018, however a delay to tweak it is much preferred to a failure.

As an additional note, Dan Jamison of the FERS Guide has released another update, I strongly suggest going over to his site and subscribing to his newsletter. He has some important benefits related information all federal employees could benefit from (no pun intended), so please take a look: https://fersguide.com/

That is all I have for now, thanks for reading. Please continue to share this site with your friends, coworkers, and colleagues.

Thank you….

-Bill Pritchard